Women globally are making significant strides in agriculture, health, and education, and more, driving global and regional knowledge economies of scale.

The situation in Pakistan, a nation brimming with potential, is not that encouraging, however. For too long, traditional barriers have stifled women's participation in the formal economy. According to a report by the Atlantic Council, Pakistan’s women’s labor force participation rate is 21.1pc, and the country ranks 145th out of 146 on the Economic Participation and Opportunity subindex of the World Economic Forum’s Global Gender Gap Report.

But things are looking up, albeit slowly. The convergence of Fintech (financial technology), financial inclusion, and the burgeoning spirit of women's entrepreneurship is paving the way for a more equitable and prosperous future for Pakistan.

The Unbanked and Underserved

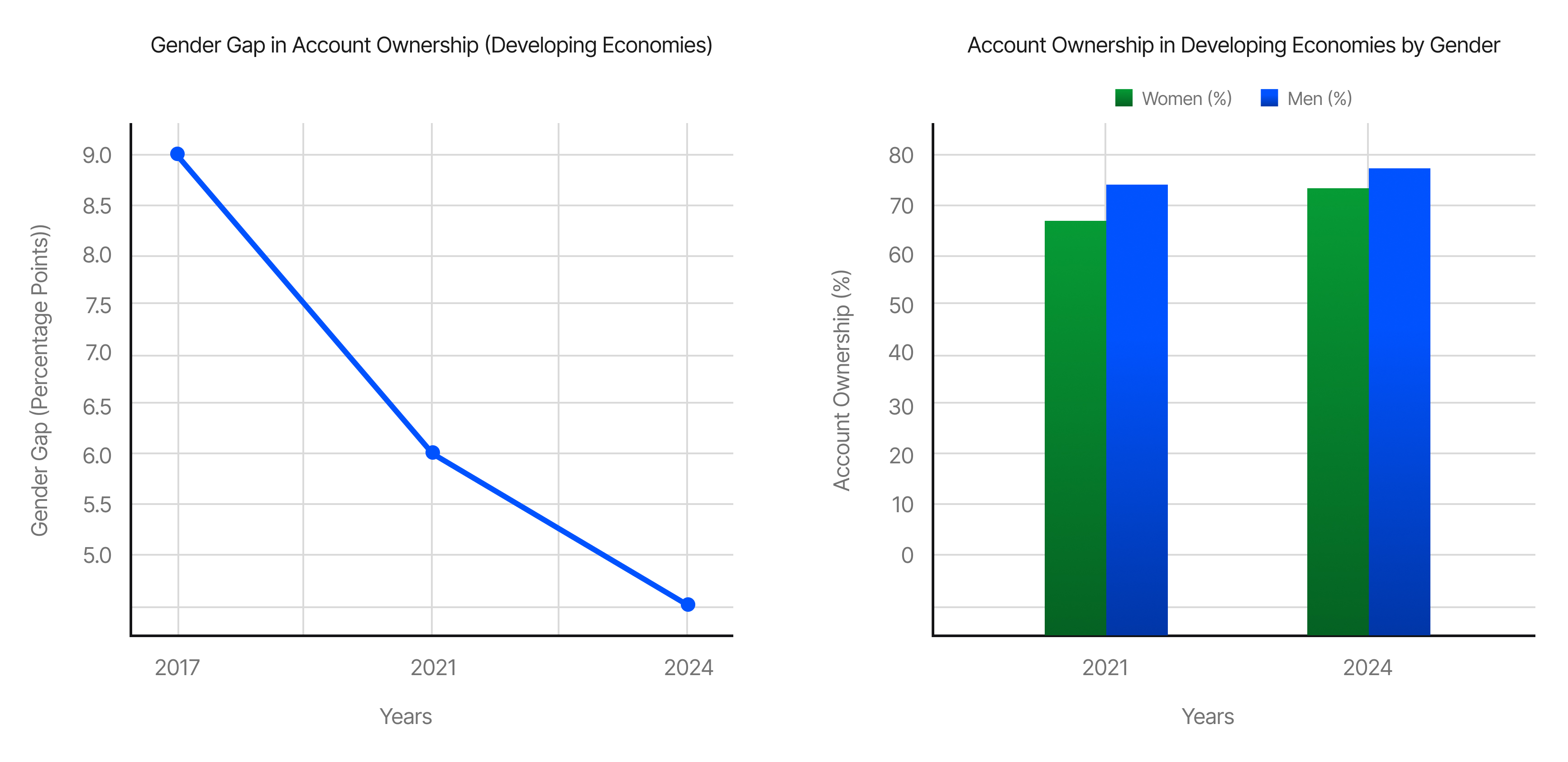

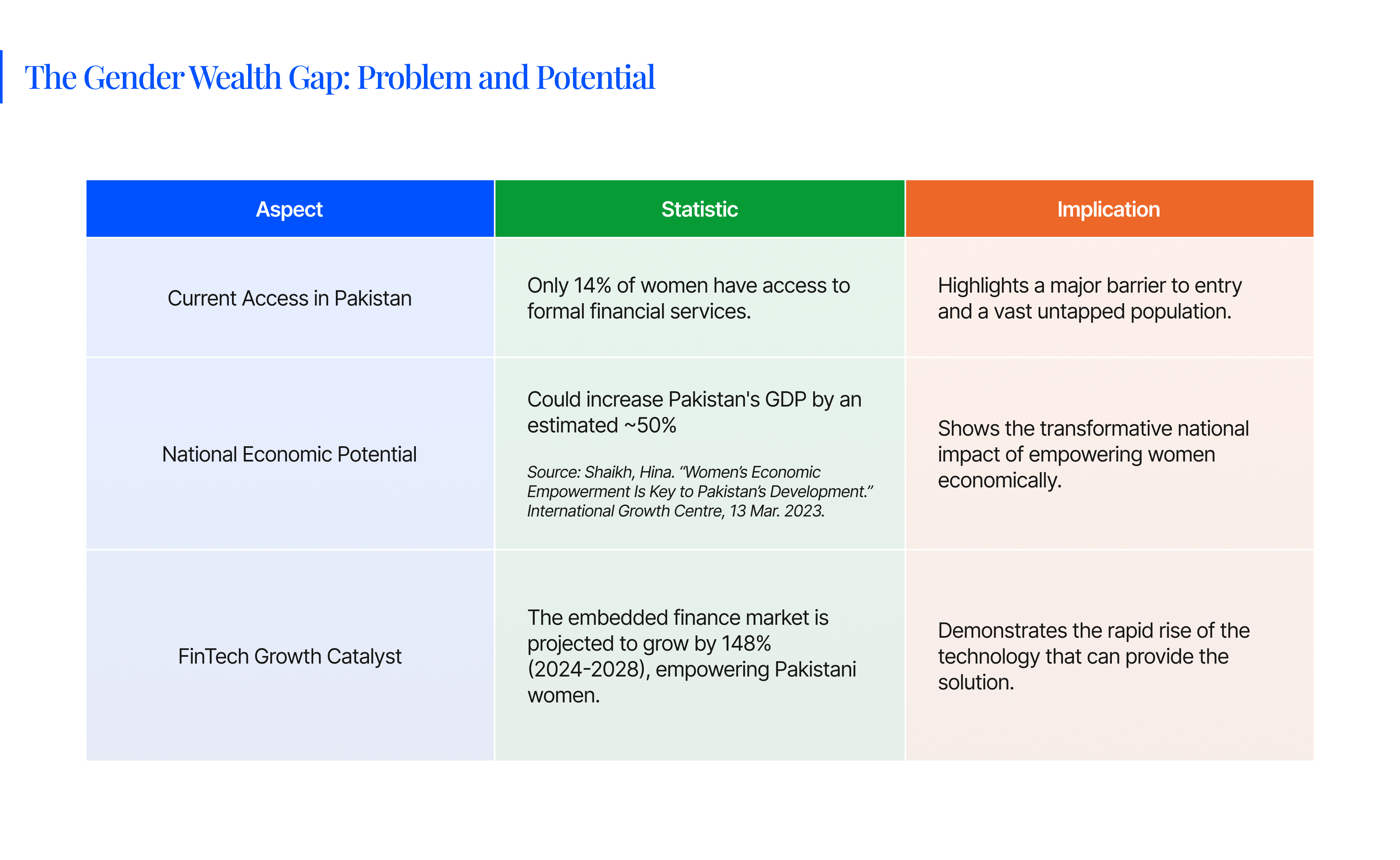

Despite being nearly half of Pakistan's population, women have historically faced immense hurdles in accessing formal financial services. Per a report by Profit, only 14pc of women in Pakistan have access to financial services. This exclusion isn't just a matter of access to bank accounts; it translates to limited opportunities for saving, borrowing, investing, and growing businesses. Sociocultural norms, lack of necessary documentation, and limited mobility have long perpetuated this disparity, confining many women to the informal sector or impeding their entrepreneurial aspirations.

The consequences are far-reaching. When women are financially excluded, their economic potential remains largely untapped, which not only impacts their individual well-being but also the prosperity of their families and the nation's overall economic growth.

Fintech: A Catalyst for Change

Enter Fintech – the blend of technology and financial services. This innovative sector is rapidly transforming Pakistan's financial situation, offering solutions that bypass many traditional barriers. According to Juniper Research, the embedded finance market is estimated to grow by an astonishing 148% over the next five years, rising from $92 billion in 2024 to $228 billion in 2028. Inherently designed for accessibility, convenience, and efficiency, Fintech applications make them particularly impactful for underserved populations, including women.

Here's how Fintech is acting as a powerful catalyst:

- Mobile Payments and Digital Wallets: Platforms like easypaisa and JazzCash have revolutionized transactions, allowing individuals to send and receive money, pay bills, and even access micro-loans through their mobile phones. Thousands of women from low-income backgrounds are taking advantage of these services to receive payments directly from customers across Pakistan via social media orders. This has eliminated their reliance on a male relative to collect cash, increasing both their profit margin and their decision-making power within the households.

- Peer-to-Peer (P2P) Lending and Crowdfunding: Forget banks and their complex rules about collateral. These online funding platforms are a game- changer, especially for women trying to get their businesses off the ground. If you don't have a ton of formal assets or a lengthy credit history, crowdfunding can be a lifesaver. We're seeing it everywhere – women entrepreneurs are actually having more success raking in cash through crowdfunding than through traditional channels. It's like the digital wild west, but in a good way, where your idea can speak for itself, not your family's real estate portfolio.

- Simplified Onboarding and Documentation: The procedure of opening an account is being greatly simplified by fintech companies. They frequently use digital identification verification to reduce the load of cumbersome paperwork. This is a major benefit for women who occasionally encounter difficulties acquiring traditional documentation.

- Financial Literacy Tools: Many fintech platforms integrate educational modules and simplified interfaces, empowering users with greater financial knowledge and confidence to manage their money.

A Force to be Reckoned with

Despite the challenges, women's entrepreneurship in Pakistan is a force to be reckoned with. From small home-based businesses to tech-driven startups, Pakistani women are demonstrating amazing resilience, innovation, and a strong desire to contribute to their families and the economy. However, they often face unique obstacles like limited access to finance, cultural and regulatory barriers, and a lack of business skills and mentorship.

According to the World Bank, over 15,000 women are now registered as business owners with the Securities and Exchange Commission of Pakistan (SECP. While this is still a small fraction of the total, the number has been growing steadily.

Fintech Empowering Women Entrepreneurs

The true magic happens when Fintech and women's entrepreneurship converge. Fintech solutions directly address many of the financial barriers faced by women entrepreneurs:

- Democratizing Access to Capital: Digital lending platforms and crowdfunding enable women to secure microloans and larger investments for their businesses without the need for traditional collateral or extensive banking relationships. This access to working capital fuels growth and expansion.

- Streamlining Business Operations: Digital payment solutions make it easier for women-led businesses to accept payments, manage cash flow, and track transactions, leading to greater efficiency and transparency.

- Expanding Market Reach: E-commerce platforms and digital payment gateways facilitate broader market access for women entrepreneurs, allowing them to sell their products and services beyond their immediate communities, even globally.

- Building Financial Identity: By engaging with digital financial services, women are building digital transaction histories, which can eventually help them access a wider range of formal financial products and services.

Pakistani fintech startups are specifically designing products and services with women in mind, offering digital rotating savings and credit associations (ROSCAs) and aiming to become a gender-inclusive neobank. Other initiatives, such as the collaboration between Unilever Pakistan, JazzCash, Women's World Banking, and Karandaaz Pakistan, are exploring agent banking models to serve low-income women, leveraging existing networks of female retail agents.

Paving the Way

Recognizing the immense potential, the government of Pakistan and the State Bank of Pakistan (SBP) are actively working to foster financial inclusion and support women entrepreneurs.

- The SBP’s "Banking on Equality Policy" aims to reduce the gender gap in financial inclusion by promoting institutional diversity, developing women-centric products, and simplifying credit policies.

- The SBP's Refinance and Credit Guarantee Scheme for Women Entrepreneurs offers financing at concessional markup rates and provides risk coverage to participating financial institutions, making it easier for women to access loans.

- Organizations like Karandaaz Pakistan are actively promoting financial inclusion for women through technology-enabled digital solutions and initiatives like "WeHub," which offers online financial literacy and business skills training tailored for women entrepreneurs. The Sindh Enterprise Development Fund (SEDF) also offers support and subsidies for women-led businesses.

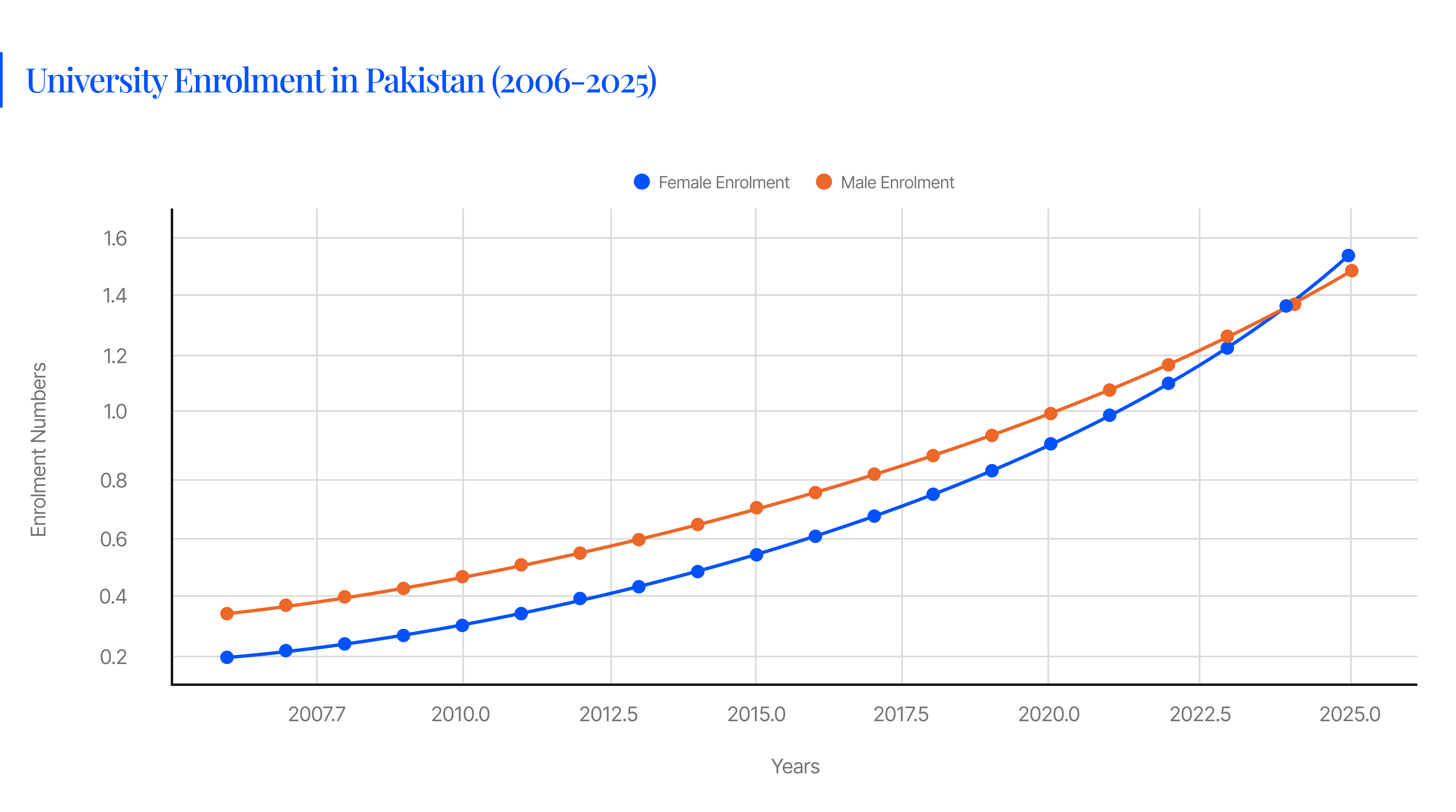

Trends in University Enrollments

Challenges and Opportunities

True, Pakistan has made progress towards women’s empowerment, but a lot still needs to be done. Digital literacy needs to be further enhanced, particularly in rural areas, to ensure widespread adoption of fintech solutions. Regulatory frameworks must continue to evolve to support innovation while protecting consumer interests. What’s more, society will need to change its mindset to fully embrace and champion women's entrepreneurial spirit.

So, can women's entrepreneurship bridge the gender wealth gap? The answer is a resounding yes, but only if it is backed by the digital bridges of FinTech and the sturdy pillars of financial inclusion. The wealth gap will not close by accident, but by design.

Contributor

Adeel Ahmed

Research Editor

Share With