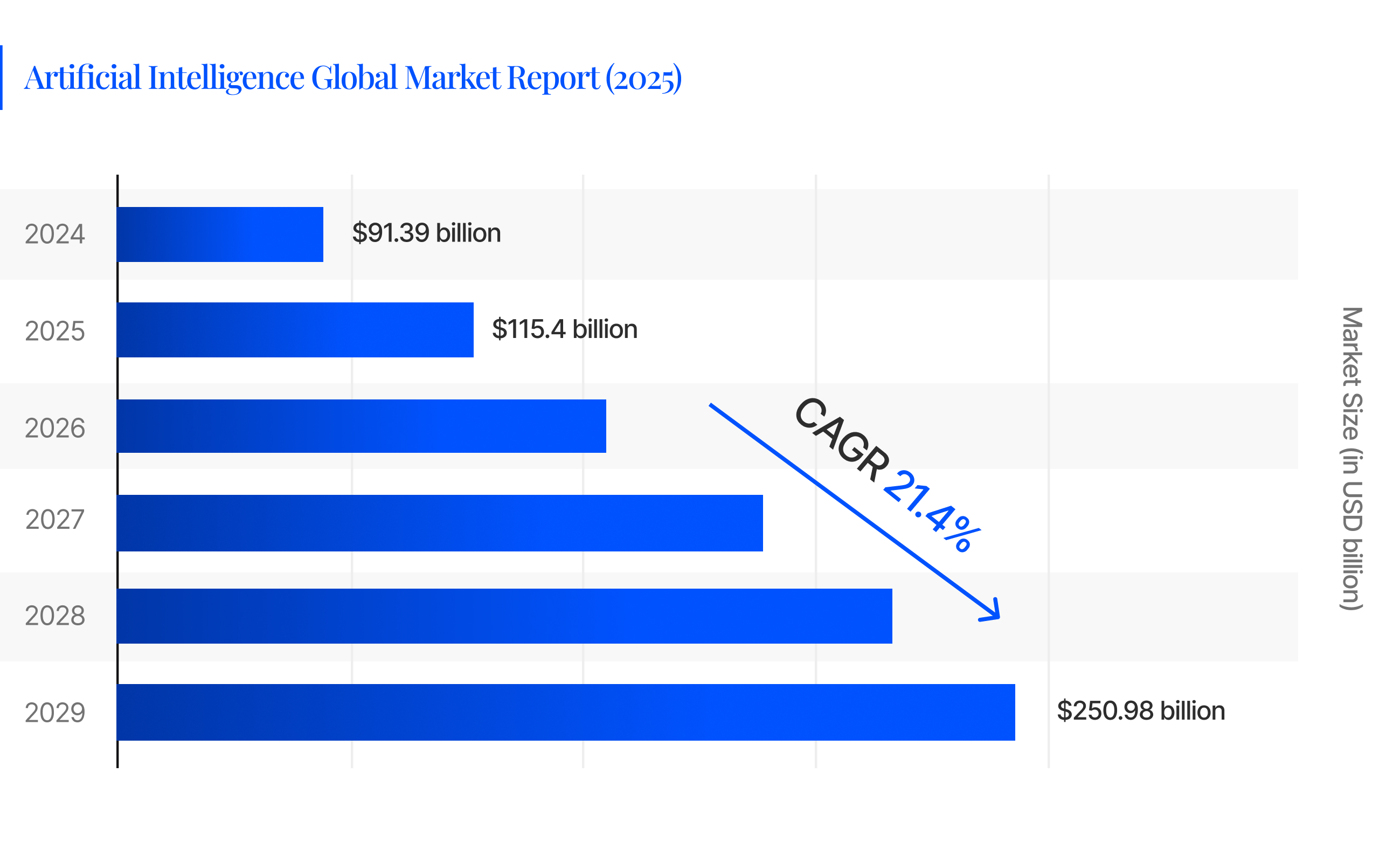

Though financial markets have been abuzz with the word artificial intelligence (AI), it’s only recently - particularly in 2025 - that the term has picked up pace. Equity research, once the sole domain of human analysts meticulously poring over company reports and news articles, is being swiftly replaced by machine learning (ML) that is enhancing human capabilities - fundamentally changing how we analyze stocks, identify opportunities, and manage risk.

And this transformation, fueled by the sheer volume and speed of data in modern finance, has far-reaching implications. Human analysts, regardless of their diligence, are not able to process the rapid flow of information in real-time – from financial statements and earnings call transcripts to social media frenzy and so on. This is where AI, particularly machine learning, comes into play.

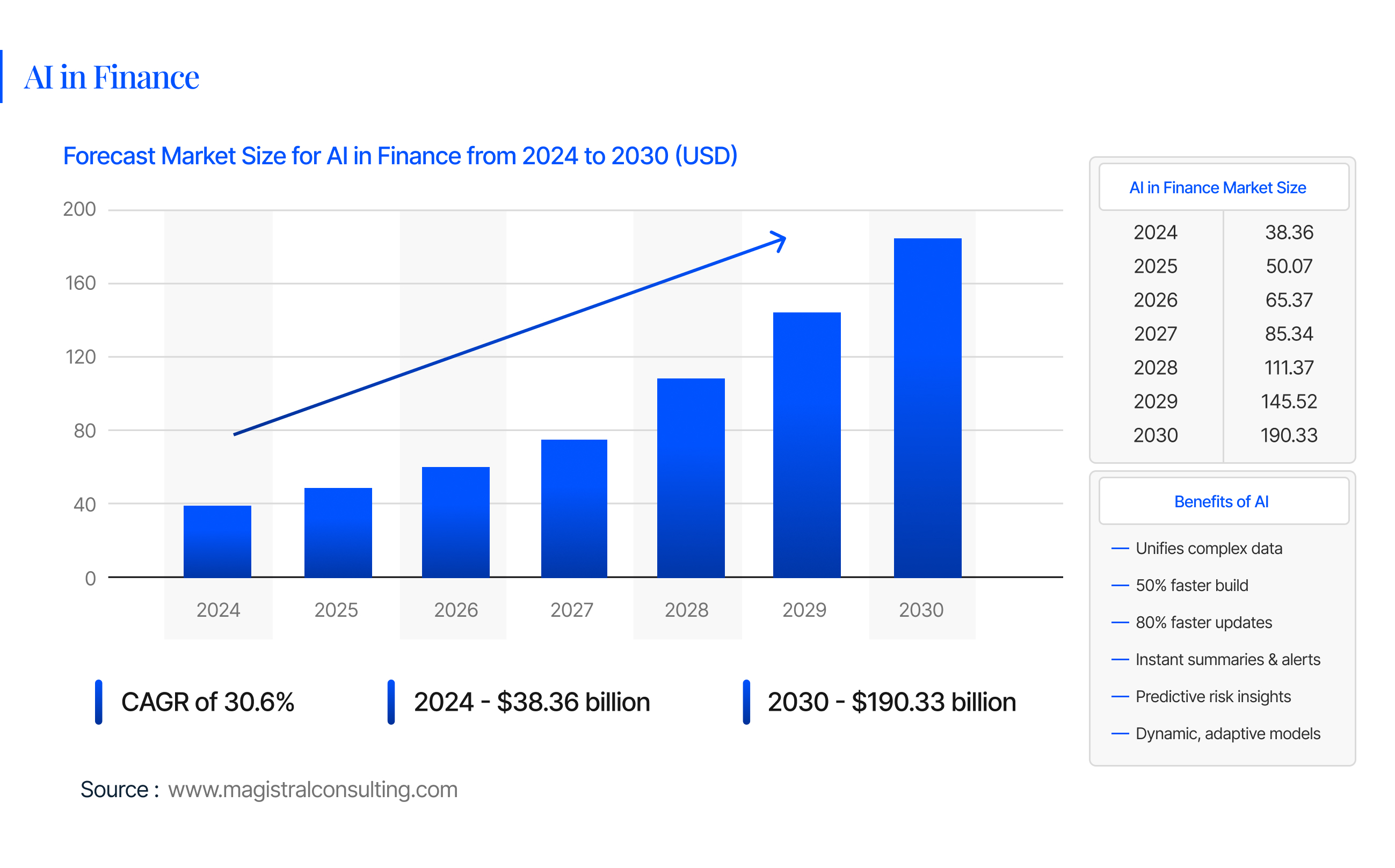

Fueling AI’s Climb

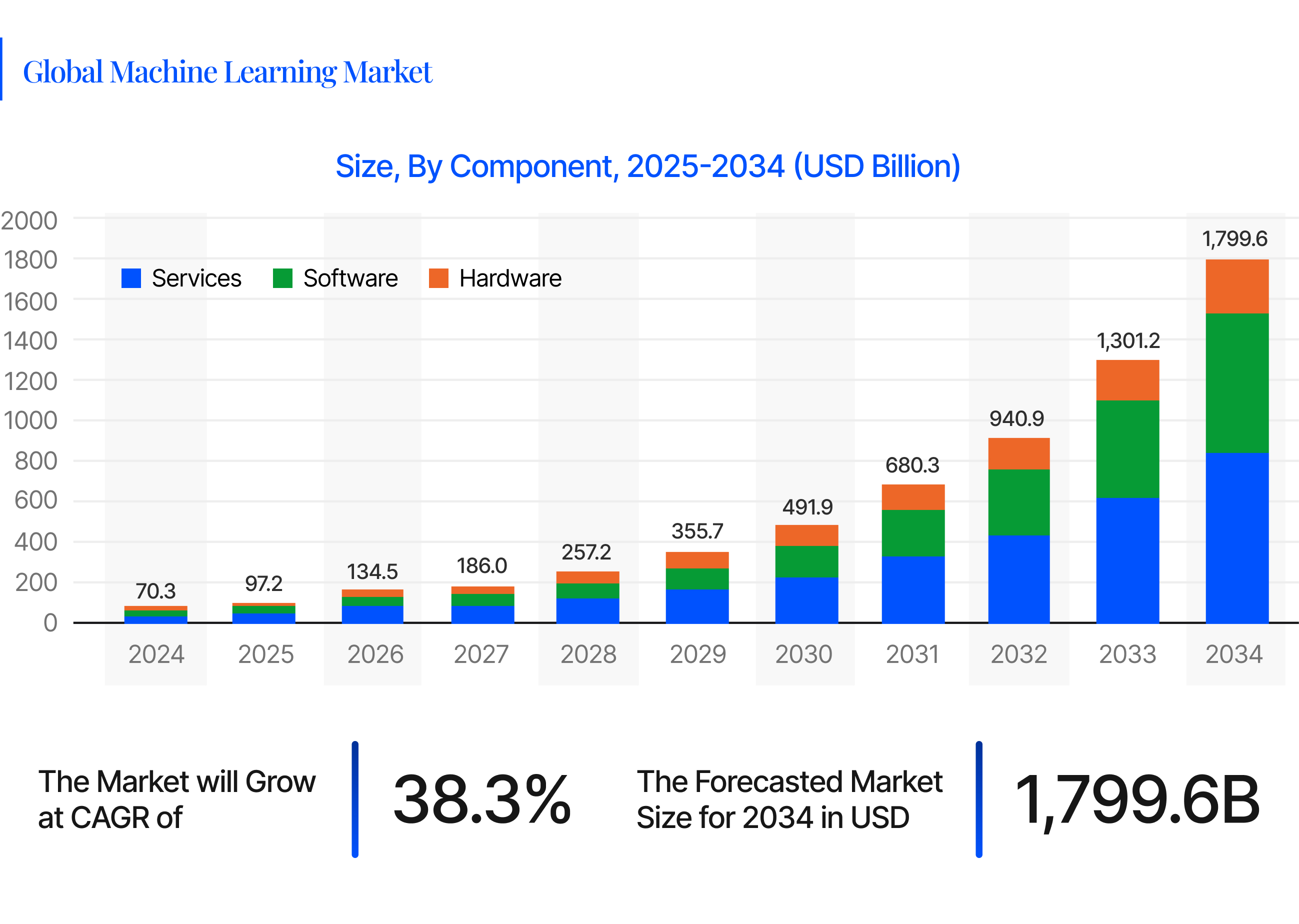

Fundamentally, equity research is about recognizing patterns and predicting future performance. Conventional approaches depend on qualitative analysis and historical financial data. But a new frontier has been opened by the advent of "alternative data," or non-traditional data sets including credit card transactions, web traffic, and even geolocation data. In these enormous, unstructured datasets, machine learning algorithms are excellent at identifying patterns and insights that people would not be able to.

Imagine that rather than passively waiting for a stuffy quarterly report, an ML model analyses supply chain data, looks at satellite images of parking lots to estimate the number of customers visiting the stores, and even scans social media to see what people are saying about the brand. Compared to those dry, old-school reports, this kind of multi-pronged analysis gives you a way faster and more complete picture of how a company’s actually doing — like getting the real dirt instead of the PR fluff. Firms like Numerai, a crowdsourced ML hedge fund that processes alternative data to uncover patterns beyond conventional fundamental analysis, have returned approximately 20% using these methods.

Intelligent Insights

AI in finance in 2025 is only about automating existing tasks is a common misconception. While automation does play a role – such as AI-powered robotic process automation (RPA) tools that process invoices and reconcile accounts with near-perfect accuracy – the true power of machine learning lies in its ability to generate smart insights.

Natural Language Processing (NLP), a subset of AI, is transforming how textual data is consumed and analyzed. Large Language Models (LLMs) like those powering tools similar to ChatGPT and Google Gemini can ingest unstructured data from news articles, earnings call transcripts, regulatory filings, and even analyst reports to generate concise research briefs, identify key risks and opportunities, and even detect subtle shifts in management sentiment. According to the CFA Institute, analysts are increasingly acting as “AI wranglers,” mastering prompt engineering to guide these models effectively.

Redefining Equity Valuation and Portfolio Management

Once a deeply hectic exercise in spreadsheets, financial modeling is getting increasingly dynamic and adaptive thanks to AI. ML algorithms can create customized valuation models that integrate varied valuation techniques like discounted cash flow (DCF), comparables, and options into a single, intelligent model. This not only boosts precision but also allows for rapid scenario analysis and stress testing, which helps investors appreciate how portfolios might perform under various market or economic crises.

In portfolio management, AI is enabling more sophisticated and dynamic rebalancing strategies. ML algorithms can continuously evaluate risk-return trade-offs, asset correlations, and market conditions in real-time, leading to improved returns, reduced risk, and personalized investment strategies that align with individual investor profiles and goals. Robo-advisors like Betterment and Weatherfront are already using AI for dynamic tax-loss harvesting and auto-rebalancing, offering these services at low fees.

The Future of the Analyst

While AI’s capabilities are undoubtedly impressive, we’re really not talking about replacing human analysts — rather, it’s all about a powerful human-AI synergy. The CFA Institute highlights that humans and AI working together will outperform either working independently. AI's strengths lie in its ability to rapidly synthesize data, recognize patterns, and process massive amounts of information with accuracy. Nevertheless, it lacks the nuanced judgment, insight, and understanding of human behavior that veteran analysts possess.

Human analysts bring to the table the ability to:

- Interpret qualitative factors: AI struggles with unspoken cues — like a CEO’s body language or understated nuance in language.

- Navigate unforeseen events: AI cannot predict truly extraordinary events — geopolitical shifts, regulatory shocks, and more.

- Build relationships and trust: Client interaction and conveying complex insights simply remain inherently human strengths.

The role of the analyst is evolving into that of an “AI wrangler” or “prompt engineer”, with mastery of LLM prompting becoming as essential as Excel used to be.

How Junior Analysts Are Leveraging AI for Improved Efficiency in 2025

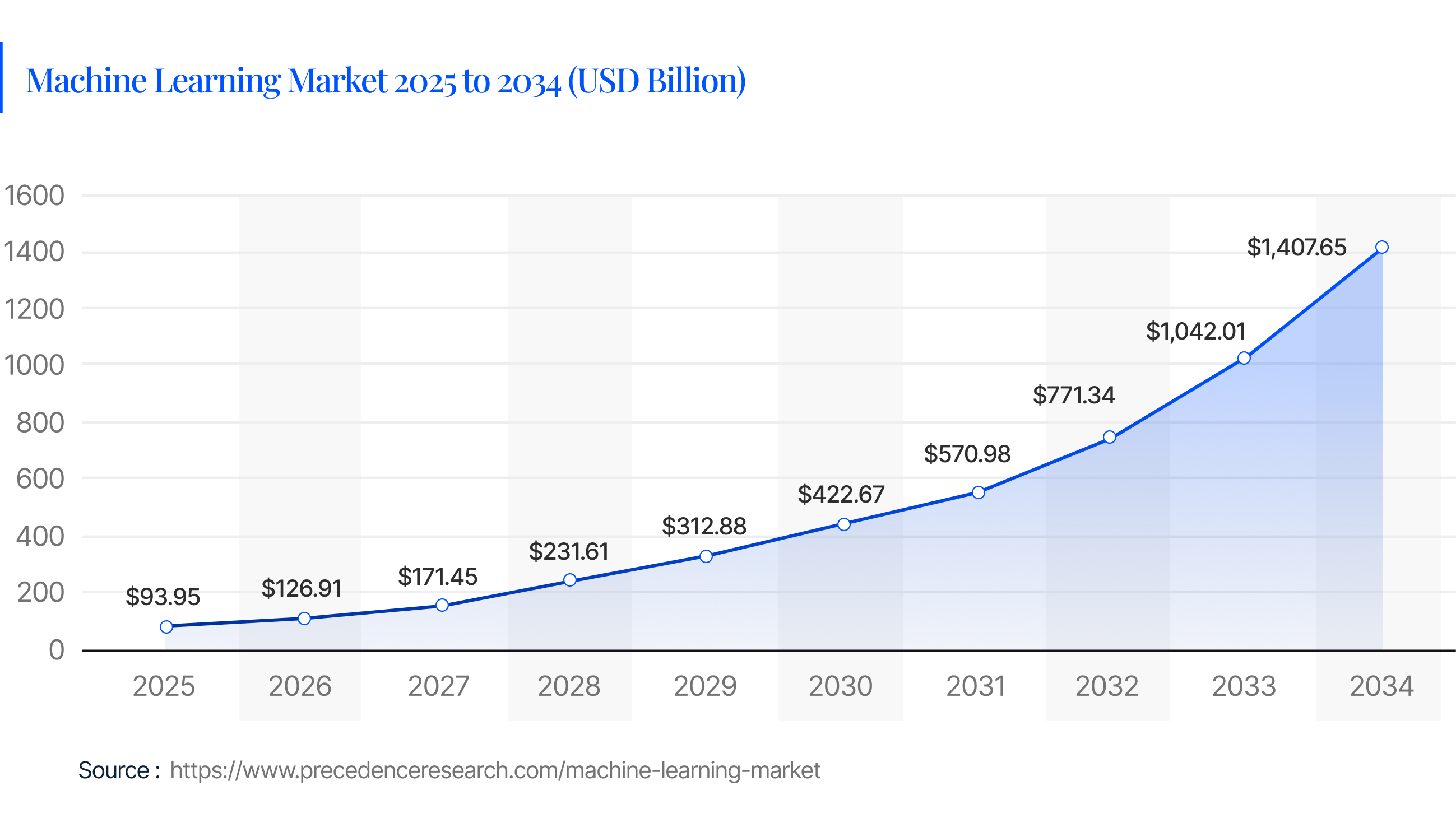

In 2025, junior equity analysts are using machine learning to boost their efficiency by automating and enhancing various aspects of their workflow; instead of manually sifting through financial reports and news, they leverage AI to automatically collect and process vast datasets, including traditional financial statements and alternative data like credit card transactions and satellite imagery.

Natural Language Processing (NLP) powered by Large Language Models (LLMs) allows them to quickly generate concise research briefs from unstructured text, identify key risks and opportunities, and even detect subtle shifts in management sentiment, effectively acting as "AI wranglers" to guide these models. AI-powered valuation models also enable dynamic financial projections and stress testing, integrating diverse valuation techniques and fast-tracking scenario analysis, while also helping in the initial drafts of financial statements.

By automating these data-intensive and repetitive tasks, junior analysts can pivot their focus to higher-value activities such as interpreting qualitative factors, preparing for unexpected events, building client relationships, and applying their nuanced human judgment.

Challenges and the Road Ahead

Despite its immense potential, AI in equity research comes with a fair share of challenges.

Data Quality and Bias: AI models are only as good as the data they are trained on. Biased or incomplete data—especially from alternative sources—can lead to flawed decisions.

Overfitting Risks: Complex algorithms can sometimes overfit historical noise, resulting in poor live-trading performance.

Regulatory Scrutiny & Explainability: Deep learning models can act as “black boxes”. Regulators now demand transparent audit trails and explainable AI approaches like SHAP and LIME. These methods help ensure AI decisions are traceable and compliant in finance.

Conclusion

It’s hard to question the prevalent use of AI-powered trading and ML-enhanced equity research in modern finance — doing so will only be to one’s disadvantage. That said, though, humans remain critical for judgement, trust, and narrative despite AI’s unprecedented speed, scale, and depth. Companies seeking to excel in these challenging times would do well to integrate AI-driven insights with skilled human analysis, aimed at creating a truly symbiotic future in equity research.

Contributor

Adeel Ahmed

Research Editor

Share With