How Spend Management Platforms are Rewriting the Rules of Enterprise Finance

Introduction

Sameer NadeemAnalyst - Advisory & Consulting

In today’s fast-paced business world, success hinges not just on innovation and growth, but on how well companies control expenses and manage costs. Without a solid spend management strategy, businesses risk wasteful expenses, data blind spots, and missed savings opportunities. Traditional methods are slow and resource-heavy, holding teams back from making smarter, data-driven decisions. As per an article published on OmniCard, spend management covers every aspect of a company's financial outflows, from procurement and petty cash management to travel expenses and operational costs.

What is spend management and why is it important for enterprises?

Spend Management (SM), a vital component of financial management, is the practice which supports businesses to monitor, manage and control their expenses effectively to enable cost savings and increase efficiencies in operations. At its core, it is about making sure that every dollar spent delivers maximum value while reducing costs and mitigating risks. It differs from traditional expense management in that it offers a more integrated approach, incorporating the planning, controlling, and optimizing of all organizational spending and helping businesses determine how, when, and why to spend, whereas traditional expense management primarily focuses on what was spent and where, typically after the transaction has taken place.

According to a study by Coupa, 46% of CFOs lack complete visibility into the transactions within their organizations. This highlights the importance of modern SM in enterprise finance as it touches all areas of company spending and uses technology to consolidate fragmented back-office processes, creating a unified view of company expenses. This brings finance teams out of the dark and empowers finance leaders to make faster, smarter decisions on resource allocation, helping to prevent budget overruns, mitigate compliance risks, and avoid strategic missteps.

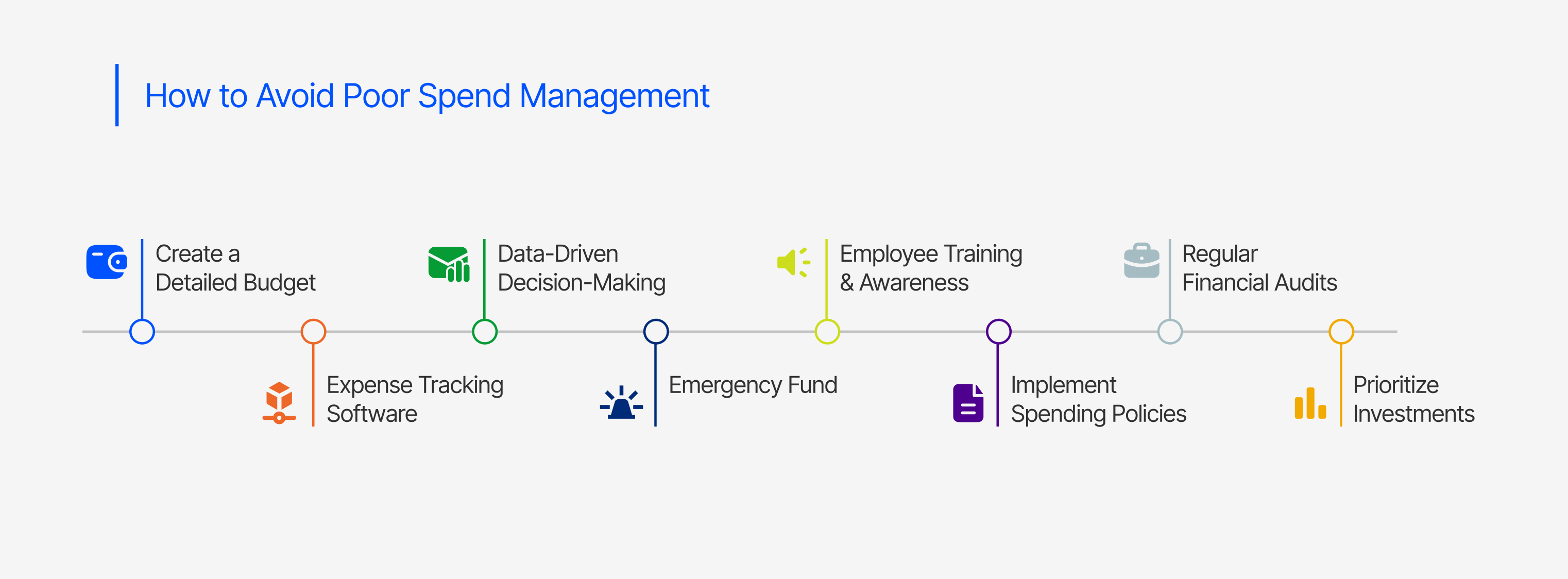

How SM evolved to address inefficiencies

SM has progressed from merely being an administrative task, driven by technological advancements and the increasing need for businesses to gain control over their financial operations. In the early days, managing business spending was a time consuming and error-prone process, resulting in a high risk of non-compliant or fraudulent transactions. Companies relied on paper invoices, spreadsheets, and manual approvals, often juggling piles of paperwork and chasing signatures just to clear a single expense. In the absence of real-time data, decision-makers were forced to rely on outdated information, which resulted in missed opportunities and financial missteps. To address these issues, businesses started adopting standalone digital systems to manage specific functions, such as procurement and employee expense management systems. While it was a step forward, these systems were often siloed, limiting their effectiveness. That’s when integrated, cloud-based SM platforms began to emerge as they addressed inefficiencies in isolated SM processes by consolidating all expense-related functions into one unified system and enabled businesses to automate expense tracking and improve data accuracy, transforming SM into a strategic, streamlined process that supports smarter financial decisions.

Benefits and core features of SM platforms

SM platforms offer businesses a digital, easy-to-use system for tracking, controlling, and analysing their spending, helping them make better, data-driven decisions in today’s rapidly evolving financial landscape. These platforms centralize financial data together in one place, automate key tasks using AI and integrate smoothly with existing accounting and ERP systems. This allows for real-time tracking of expenses and automatic syncing of transactions, which not only improves accuracy but also lightens the load for finance teams, freeing them up to focus on more strategic work. According to a recent CPA survey, 97% of such businesses using SM tools reported improved control over spending and stronger budget adherence.

1) Data transparency and real-time expense tracking: SM platforms offer a centralized view of financial data, making it easier to monitor spending in real time. This level of transparency allows businesses to catch discrepancies or unexpected expenses before they escalate by tracking every transaction as it happens. Finance teams gain instant visibility across departments, can forecast spending more accurately, and make prompt adjustments to avoid budget overruns. The ability to consolidate data from sources like invoices, purchase orders, and expense reports also enables smarter reporting and dashboard creation, giving businesses a full picture of where their money goes.

2) Cost optimization and strengthened supplier relationships: With these platforms offering immediate access to up to date spend data, companies can easily identify overspending and inefficiencies, enabling them to take smart steps toward cost savings. Increased visibility, accountability, and the ability to manage spending at every level, project, department, or vendor, enables finance leaders to fine-tune their budgets with precision. These platforms also simplify procurement processes and improve vendor negotiations, helping secure better pricing and terms while strengthening long-term supplier relationships.

3) Risk and compliance management: SM platforms are designed for businesses to stay on top of compliance and detect potential fraud early. With built-in AI alerts and automated policy checks, companies can identify suspicious transactions and ensure strict adherence to internal policies and external regulations. This not only helps prevent regulatory breaches and reduce instances of fraud but also strengthens overall governance and financial control.

4) Informed decision-making and budgeting: These platforms empower businesses to make smarter, more strategic decisions by turning real-time data into actionable insights. Unlike traditional budgeting, which often relies on outdated information, these tools use AI and predictive analytics to forecast spending more accurately by identifying patterns, inefficiencies, and cost-saving opportunities. This allows finance teams to make proactive adjustments, rather than reacting to issues after the fact. With more accurate forecasting and dynamic budget control, organizations can better align their resources with strategic goals and stay agile in an ever-changing market.

5) Process efficiency through automation: By automating routine tasks like approvals and invoice processing, these platforms reduce manual errors and save time. This boosts team productivity, lowers operational costs, and allows finance teams to focus on high-impact work.

Conclusion

In an increasingly complex financial landscape, adopting a spend management platform isn’t just about saving money; it is a necessity for businesses aiming to stay agile, efficient, and financially sound. By centralizing data, automating routine tasks, and delivering real-time insights, these tools take the pressure off finance teams and empower organizations to control costs, improve decision-making, and reduce financial risk.

Contributor

Adeel Ahmed

Research Editor

Share With