Does Equity Research Hold Value in Pakistan’s Volatile Market?

It would be unjust to label Pakistan's stock market, the Pakistan Stock Exchange (PSX), only as a breeding ground for frequent storms, as some analysts put it. It’s also a land of opportunity. The periodic upheavals the financial nerve center experiences, chiefly fueled by the country’s economic uncertainty, leave many investors wondering if equity research holds value in such a precarious environment.

The investors’ consternation is not unjustified, but it’s not all doom and gloom. True, volatility does pose challenges frequently, but strong equity research can be a valuable tool for investors navigating the choppy waters of the PSX.

Equity research vs. technical analysis

Equity research involves gaining insights into a company's financials. Acting like financial sleuths, analysts examine things like earnings, debt, and management to appreciate the company's true worth. They do that to reveal whether a stock is trading above or below its intrinsic value, especially its fair market price. This long-term approach helps investors make informed decisions about buying and holding stocks for months and even years.

On the contrary, technical analysis is all about the stock itself, where technicians study historical price movements and trading volume to identify patterns and trends. Their aim? To predict short-term price movements based on past behavior and market sentiment. So, instead of a company’s inherent value, they look for trading signals. This approach is suitable for day traders and short-term investors who focus on price jitters that can occur within minutes, days, or even longer.

Beyond just stock prices

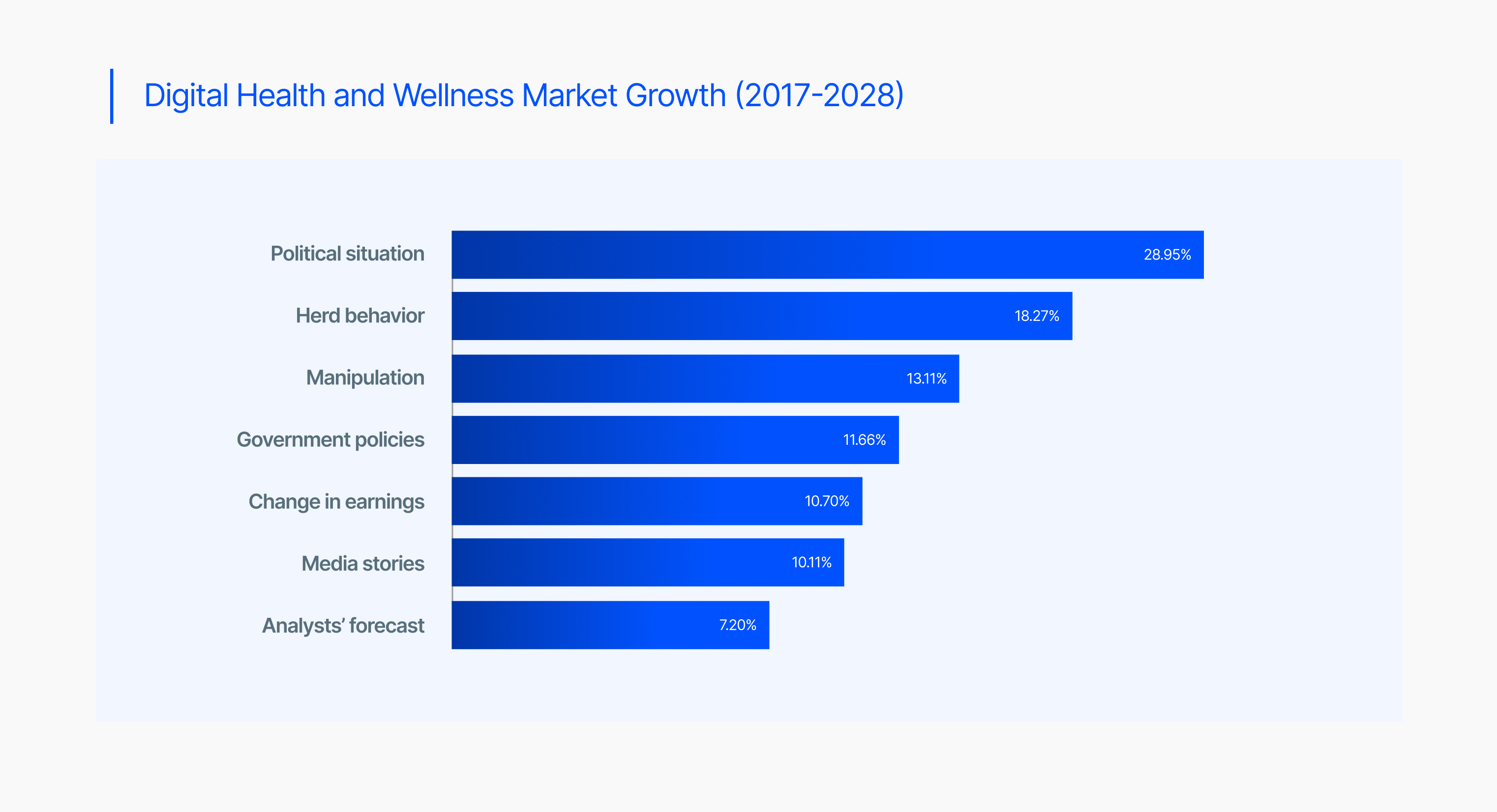

The PSX is greatly influenced by a number of factors, from global oil prices to political developments at home. For example, the Russia-Ukraine war significantly impacted global energy prices in 2022, which in turn, influenced the Pakistan’s macroeconomic situation and the stock market. In-depth equity research not only deals with projected stock price and expected returns, but it also analyzes the financial health of companies, their competitive ecosystem, and their exposure to macro-economic risks. This knowledge allows investors to make informed decisions that are not swayed by short-term market jitters.

Blessing in disguise

Volatility is not all adversity; it also presents opportunities. Quality stocks are likely to lose value when the market panics. This is where meticulous equity research stands out. Investors can identify temporarily mispriced stocks due to market fluctuations by evaluating a company’s fundamentals, future growth prospects, and long-term potential. Research by prestigious firms with a proven track record can expose these hidden gems, enabling investors to capitalize on long-term value.

Mitigating risk in uncertain times

While volatility impacts potential gains, it also amplifies potential losses. Robust equity research can help mitigate this risk. Research analysts are well-positioned to identify companies that are more resilient to economic upheavals if they effectively evaluate a firm’s financial strength, debt levels, and risk management strategies. This allows investors to build a portfolio that can navigate through market storms.

Challenges remain

It would be a wrong to assume that it’s all hunky-dory for equity research in Pakistan. If anything, it grapples with a set of challenges. For one, since the analyst community is still developing, the quality of research may not be very high. This situation prompts investors to be very discerning and rely only on research from well-known firms with proven track records. There’s another catch: the fast-paced nature of the Pakistani market can make it difficult for research to keep up with rapidly changing circumstances.

Conclusion

Pakistan's volatile market presents both challenges and opportunities for investors. When done carefully and with thoughtful interpretation, equity research may be a very useful tool for navigating this dynamic landscape. Even in these chaotic times, investors can use stock research to achieve their financial goals by limiting risk, locating discounted opportunities, and comprehending the underlying currents. Although it's not a magic wand, equity research is an invaluable resource. To make prudent choices in Pakistan's exciting but challenging market, consider research in addition to your personal judgment, risk tolerance, and investment objectives.

Share With