Why Investor Relations (IR) Is Critical for Publicly Listed Companies — Especially in Today’s Capital Markets

Introduction

Investor Relations (IR) has evolved from a simple function of financial reporting to a strategic necessity for publicly listed companies. In today’s fast-paced and unpredictable capital markets, IR is no longer just about publishing financial statements—it’s about storytelling, trust-building, and fostering meaningful relationships with investors. With economic uncertainties, shifting regulations, and increasing scrutiny from institutional and retail investors alike, companies that invest in a strong IR strategy are better positioned to navigate challenges, maintain market confidence, and sustain long-term growth. The role of IR has never been more critical in ensuring transparency, mitigating risks, and enhancing shareholder value.

What is Investor Relations?

Investor Relations is the strategic management function responsible for ensuring effective two-way communication between a company and its investors. It bridges the gap between corporate management and shareholders by providing timely, transparent, and accurate financial and strategic updates. Through earnings reports, investor meetings, regulatory filings, and direct shareholder engagement, IR fosters trust and confidence in the company’s market positioning. The core objective is to support fair valuation, enhance liquidity, and cultivate long-term investor relationships.

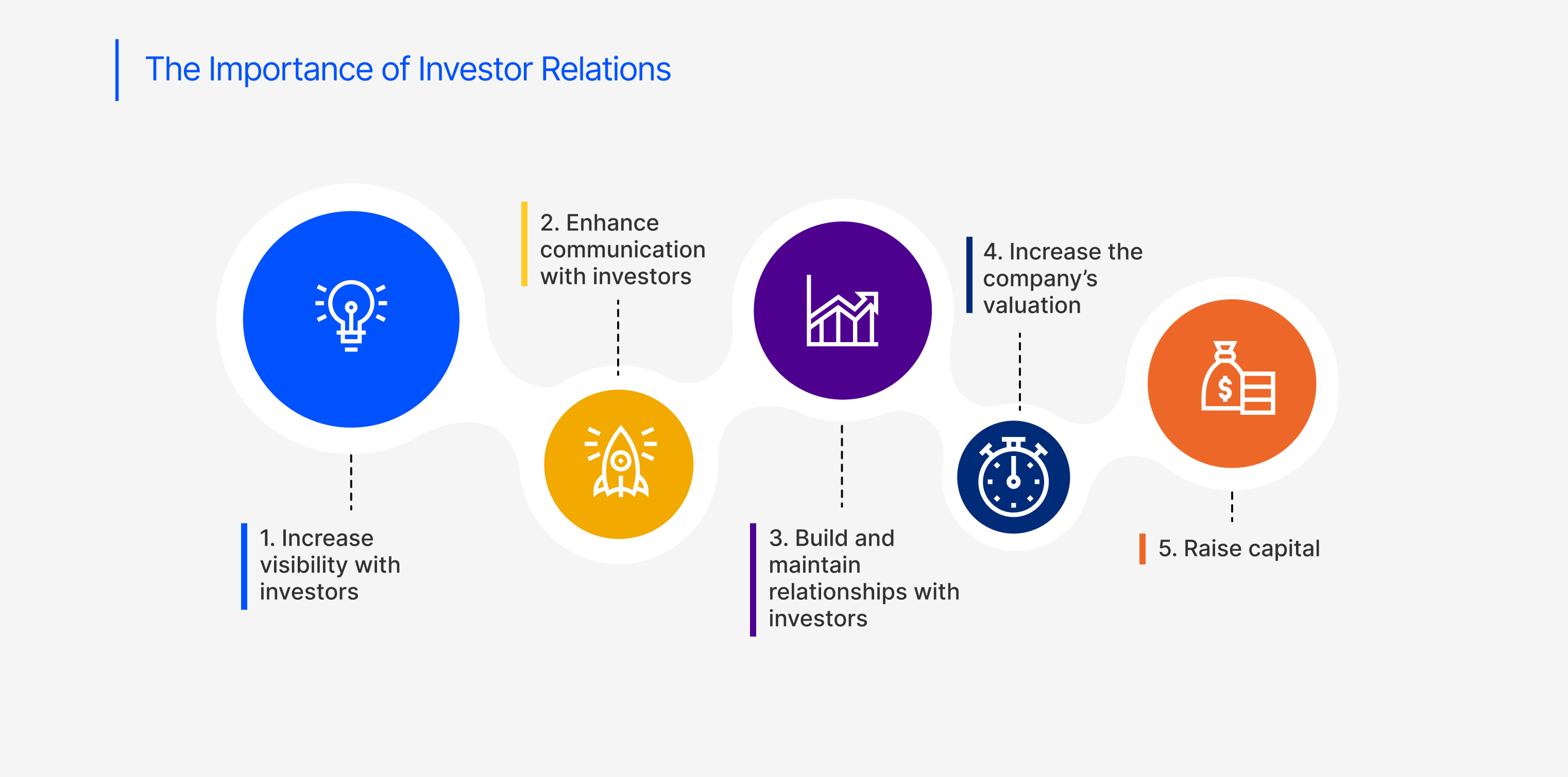

The Role of Investor Relations in Publicly Listed Companies

Imagine you’re an investor evaluating a company’s stock. You want to know if the company is growing, whether management is making sound decisions, and if it’s a safe place to park your money. This is where IR steps in—bridging the gap between the company and investors by providing clear, accurate, and timely information.

Strong IR practices help companies communicate their strategic direction, financial health, and market potential. This transparency builds investor confidence and reduces market speculation. Companies that engage proactively with analysts, shareholders, and financial media create a positive perception in the market, which can lead to higher valuations and better stock performance. Earnings calls, investor presentations, and direct shareholder engagements all serve as crucial tools to maintain investor trust and stability.

The Importance of IR in Today’s Capital Markets

The capital markets today are more volatile than ever, influenced by global events, technological advancements, and economic cycles. Investors demand real-time insights and reliable data to make informed decisions, and companies that fail to deliver this information risk losing market confidence. Misinformation and speculation can quickly cause stock prices to plummet. A well-structured IR strategy ensures that investors receive accurate and consistent updates, preventing market panic and uncertainty.

Take, for instance, the rise of ESG (Environmental, Social, and Governance) investing. Today’s investors don’t just look at financials—they want to know how a company operates ethically, addresses climate change, and contributes to social causes. Institutional investors and asset managers increasingly allocate capital to companies with strong ESG initiatives. As a result, IR teams must integrate ESG metrics into their investor communications, ensuring compliance with global standards like the Task Force on Climate-Related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) . Companies that effectively communicate their ESG efforts are more likely to attract long-term, sustainability-focused investors.

Regulatory compliance is another critical factor. Governments and financial watchdogs impose stringent disclosure requirements to ensure market fairness. Failure to comply can lead to heavy penalties, lawsuits, and reputational damage. IR professionals play a vital role in ensuring that a company’s reporting aligns with the rules set by regulatory authorities such as the U.S. Securities and Exchange Commission (SEC) and the European Union’s MiFID II . By adhering to these regulations, companies not only protect themselves legally but also build credibility with investors.

Additionally, the investment landscape has become more competitive. With numerous companies vying for capital, businesses must differentiate themselves to attract investors. Companies with strong IR programs, compelling investment narratives, and transparent financial reporting stand out in the crowd. Roadshows, earnings calls, and investor meetings are now more crucial than ever for companies seeking capital in both public and private markets.

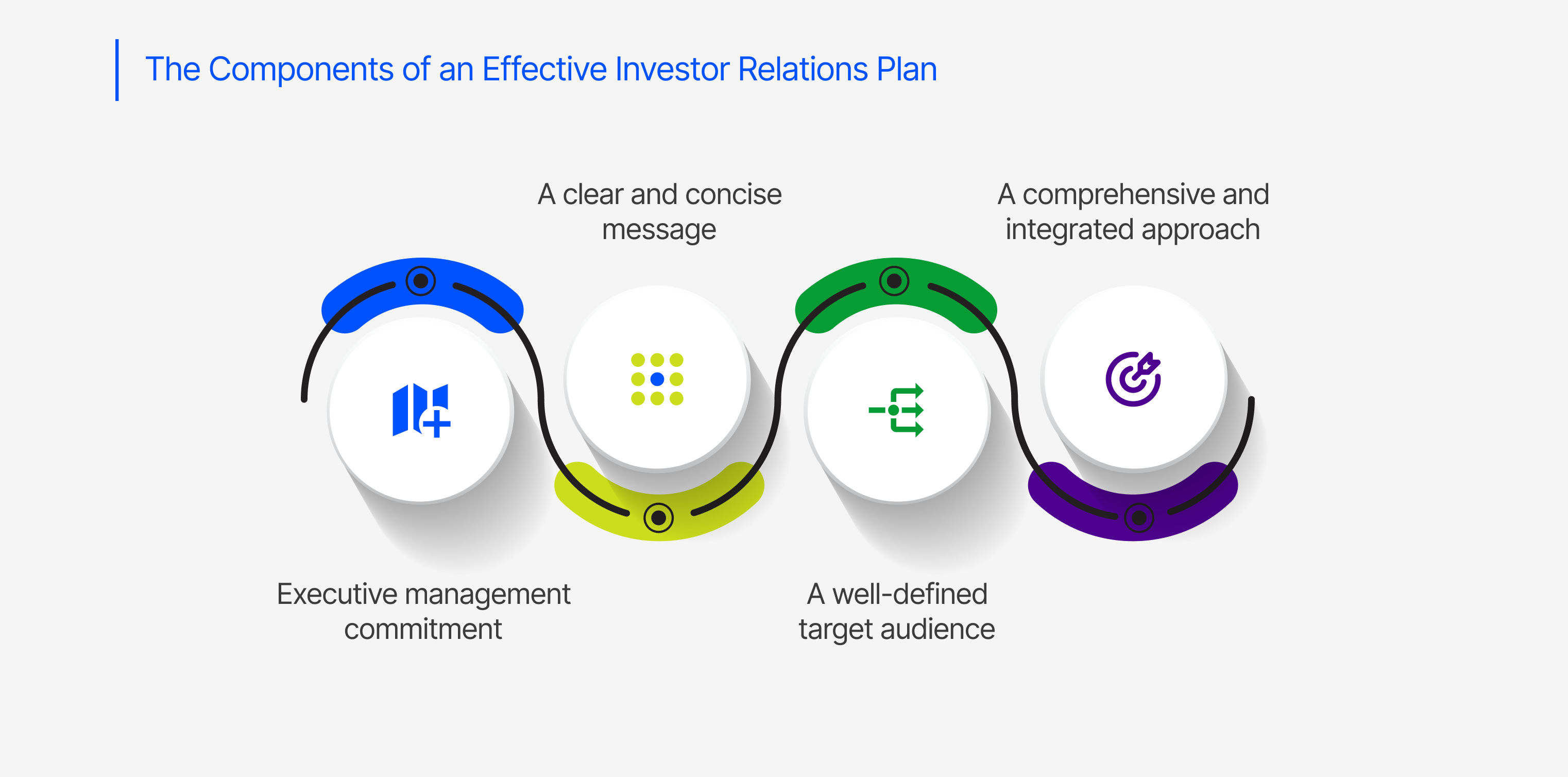

Key Components of an Effective Investor Relations Strategy

At the heart of successful IR is clear, consistent, and proactive communication. Investors don’t like surprises—so companies must provide timely updates on financial performance, strategic initiatives, and potential risks. Regular earnings reports, press releases, and investor presentations keep stakeholders informed and engaged.

Beyond traditional communication, digital transformation has changed how companies interact with investors. A well-designed IR website with easily accessible financial reports, FAQs, and multimedia presentations enhances transparency. Social media platforms like LinkedIn, X (formerly Twitter), and YouTube allow companies to connect with investors in real time, breaking down barriers between executives and shareholders. The rise of virtual roadshows and hybrid investor meetings has further expanded engagement, enabling global investors to participate in corporate events without geographical constraints.

Crisis management is another vital aspect of IR. Markets can react unpredictably to negative news—be it a financial downturn, executive departure, or regulatory investigation. Companies that communicate promptly and transparently during crises can mitigate damage and reassure investors. A crisis communication plan that includes a dedicated response team and a clear messaging strategy can prevent misinformation from spreading and stabilize investor sentiment.

Additionally, aligning IR with corporate strategy is essential. Investors need to see a clear roadmap for growth and profitability. IR teams should work closely with executive leadership, finance departments, and legal teams to craft messaging that aligns with long-term business objectives. A well-communicated growth strategy fosters confidence among investors and strengthens shareholder relationships.

The Future of Investor Relations

Investor Relations is no longer just a corporate function—it’s a competitive advantage. In today’s unpredictable capital markets, companies with strong IR strategies are better equipped to attract investors, navigate crises, and sustain long-term growth. Transparency, engagement, and adaptability define successful IR programs, ensuring that businesses maintain credibility and investor trust.

The future of IR is being shaped by technology, data analytics, and the evolving investment landscape. Companies are increasingly using artificial intelligence (AI) and predictive analytics to track investor sentiment, monitor stock performance, and tailor communication strategies. AI-driven insights help IR teams craft data-backed messaging that resonates with investors.

Post-pandemic, digital engagement remains a key focus for IR teams. The shift toward virtual investor relations—through online meetings, webinars, and AI-powered chatbots—has made it easier for companies to connect with global investors without the limitations of physical events. This digital-first approach allows businesses to maintain cost-efficiency while reaching a broader audience.

Retail investors, once overlooked in traditional IR strategies, are now playing a bigger role in market movements. Platforms like Robinhood, Reddit’s WallStreetBets, and Twitter have demonstrated the power of retail investors in driving stock prices. Companies can no longer afford to ignore this growing segment and must tailor IR efforts to engage them alongside institutional investors. A well-balanced approach that includes transparent communication with both institutional and retail investors is becoming increasingly important.

Conclusion

By embracing digital transformation, ESG integration, and proactive communication, companies can future-proof their IR efforts and remain resilient in an ever-evolving financial landscape. As markets continue to shift, IR will remain a crucial driver of corporate success, shaping how companies are perceived and valued by investors worldwide.

Contributors

Adeel Ahmed

Research Editor

Share With