The future is contactless: Exploring the digital payment boom in KSA

For decades, cash was an integral part of Saudi Arabia’s economy—deeply rooted in the culture and trusted in everyday transactions, from traditional markets to neighbourhood stores. However, the Kingdom is now undergoing a remarkable digital transformation, reshaping its financial landscape and accelerating its shift toward a cashless society. According to the Saudi Central Bank (SAMA), electronic payments in the retail sector made up over 70% of total transactions in 2023, an increase from 62% the year before, while a recent report highlighted a 40% surge in digital transaction usage during the same period.

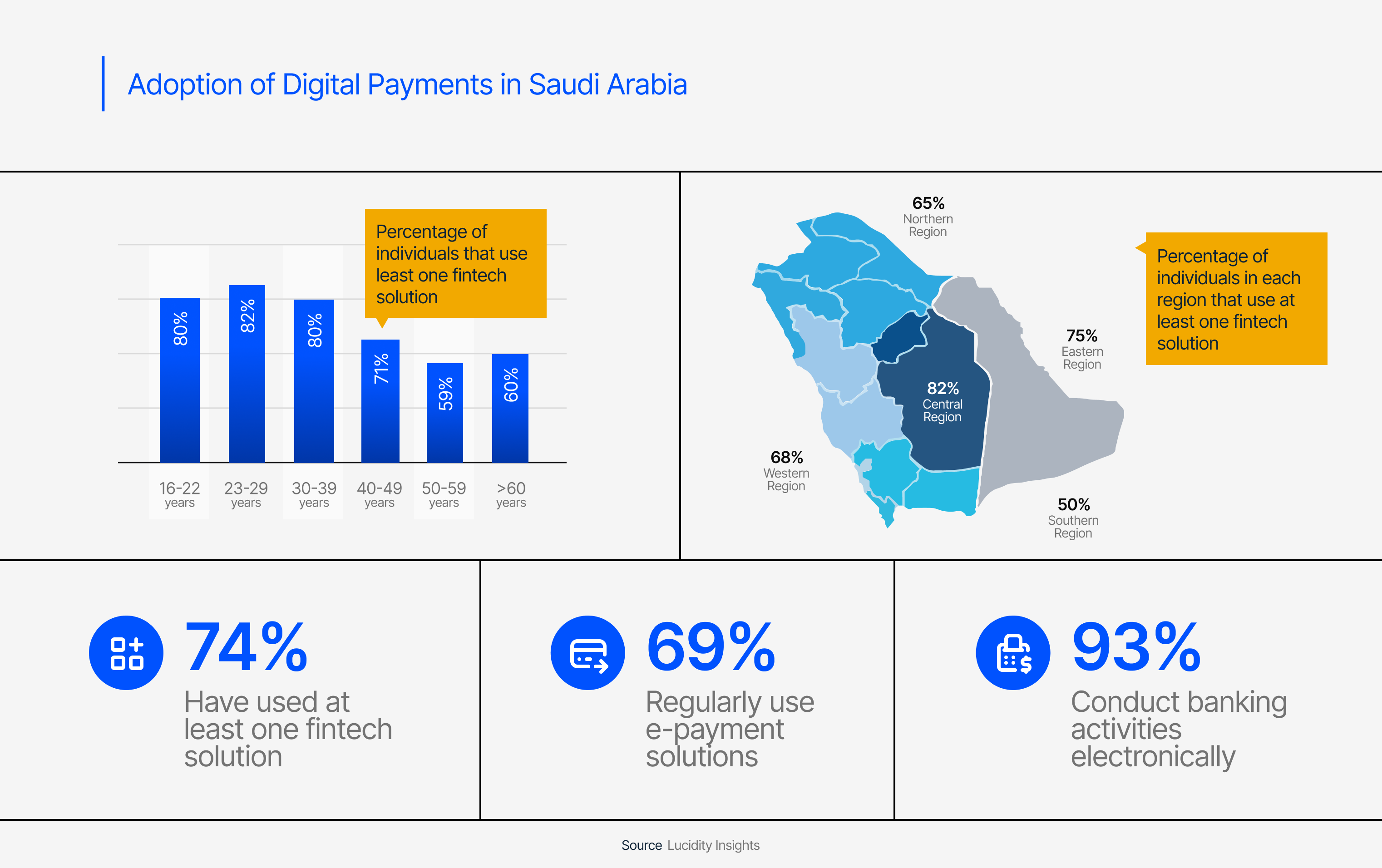

At the heart of this exciting transformational journey is the Vision 2030 initiative, which is part of a broader national strategy aimed at fostering digital innovation and financial inclusion. The government’s initiatives play a pivotal role in driving digital innovation across society, accelerating the adoption of digital payments through the rise of mobile wallets, contactless transactions, and fintech innovations, especially among the young, tech-savvy population.

Government’s role in turning vision into reality

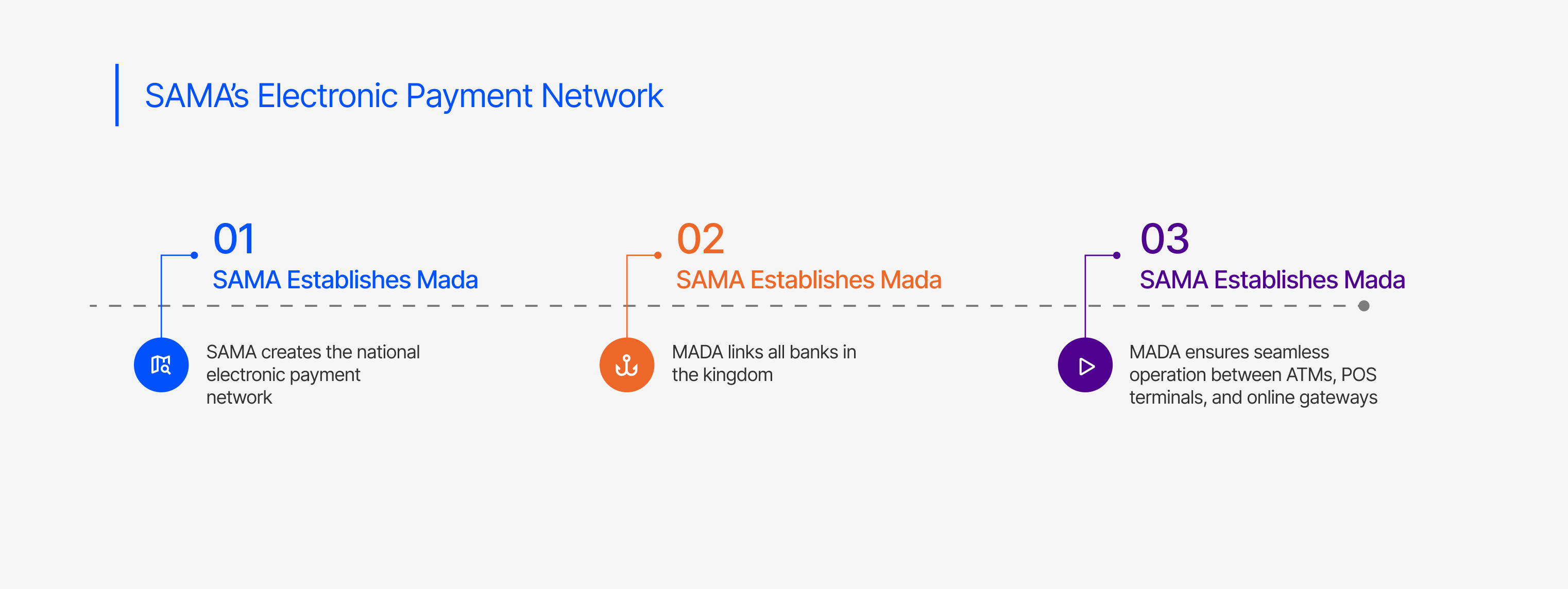

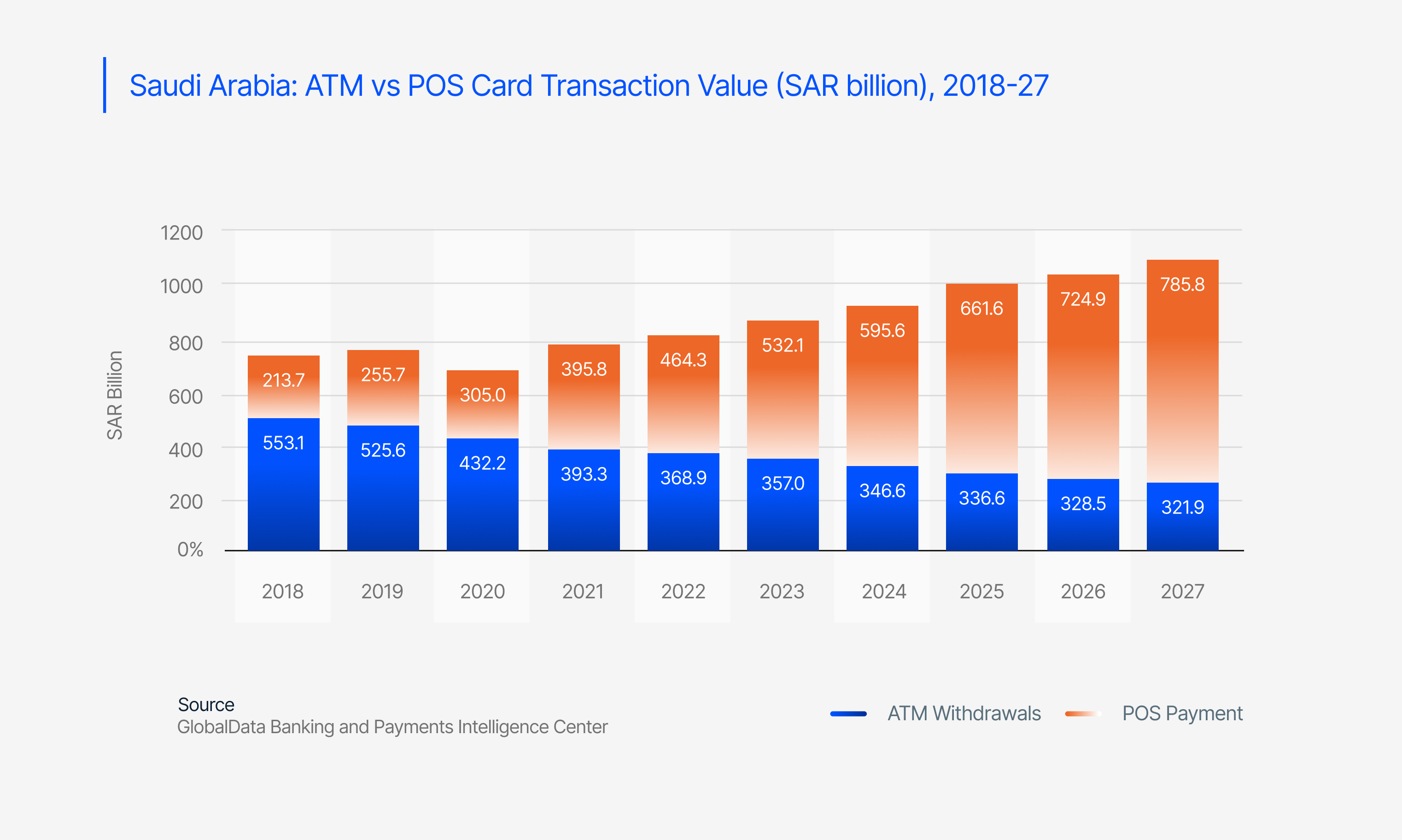

Saudi Arabia’s transition toward a cashless economy has been significantly driven by targeted government policies and regulatory support, as part of Vision 2030, which aims to increase the share of non-cash transactions to 80% by 2030. SAMA established the national electronic payment network, Mada, which connects all banks across the Kingdom and ensures seamless interoperability between ATMs, POS terminals, and online payment gateways. Mada has played a key role in driving adoption by offering a wide range of mature and reliable electronic payment solutions for their customers. With the government mandating electronic payment acceptance for all commercial activities through POS devices, Mada’s integration with digital wallets such as Apple Pay, STC Pay, and Samsung Pay has significantly expanded its reach, making digital payments accessible across all segments of the retail sector and fuelling the growing trend of mobile wallet-based transactions. According to a 2024 report by Mada, over 57% of all retail transactions in Saudi Arabia are now conducted through contactless payments, reflecting the increased utilization of digital wallets. In a research conducted, McKinsey states that mobile wallets will become one of the most common digital payment methods across the MENA region within the next five years, with KSA at the forefront.

How fintech is revolutionizing payment ecosystem in KSA

The recent surge in digital payment adoption in Saudi Arabia has been enabled by the growing number of licenses granted to fintech companies, in line with the objectives of the Financial Sector Development Program (FSDP). Financial institutions are increasingly recognizing the benefits of FinTech to offer a wide range of next generation, customised financial services to their customers and formed partnerships with international and national FinTech firms to position themselves as customer-first service providers. The recent approval of Fintech companies like Tabby and Tamara by SAMA has paved way for Buy Now Pay Later (BNPL) service options which enables shoppers to split payments across months, interest-free. Young and low-income consumers demand more flexible, convenient, and secure payment solutions for necessary expenditures, and BNPL serves just that. Moreover, the collaboration between fintech companies and banks to offer BNPL services through platforms like SADAD, a government-backed payment gateway platform in KSA which facilitates bill payments and integrates various financial services into one streamlined platform, has been a major catalyst in adoption of digital payments across all sectors. According to a recent report by Tabby, an impressive 77% of Saudi consumers now use BNPL for essential expenses, including education and healthcare, highlighting its expanding role beyond retail.

Digital payments are the new norm in Saudi shopping

Saudi Arabia’s shift toward a cashless economy is being driven by its young, digitally native population, 63% of which is under the age of 30. With smartphone penetration exceeding 95% in Saudi Arabia, this tech-savvy demographic is highly engaged with social media platforms like Instagram, Snapchat, and TikTok, which have evolved into powerful engines for product discovery and e-commerce. This shift has significantly boosted online shopping trends across the Kingdom. Once dominated by cash-on-delivery, the market has rapidly transitioned to digital payment solutions, especially since many online platforms such as Noon and Amazon now not only prefer digital transactions but also apply additional fees for COD, nudging consumers toward faster, more secure online transactions. The pandemic only accelerated this shift, as consumers embraced contactless payments for safety and convenience, and haven’t looked back since. Additionally, banks and financial institutions have sweetened the deal by offering exclusive discounts and rewards on credit and debit card usage for online purchases, reinforcing the appeal of digital payments.

Conclusion

As Saudi Arabia advances towards its goal of a cashless society, the widespread adoption of digital payments signals a profound shift in the country’s financial ecosystem. Government initiatives, the rise of fintech innovations like BNPL services, and a young, tech-driven population drive the rapid adoption of digital payments, which has now become the new norm in everyday transactions. Ultimately, with the increasing support from financial institutions, platforms, and regulatory bodies and as consumers continue to embrace digital payments, we can expect to see even more innovation and growth in the years to come. This growth will bring the country closer to realizing its Vision 2030 goals and pave the way for a modern and digital economy, one that prioritizes convenience, security, and financial inclusivity for all.

For further information, please visit our Growth & Advisory page to explore how Akseer can assist in achieving your strategic objectives.

Contributor

Adeel Ahmed

Research Editor

Share With