Why Cybersecurity is Paramount in Finance

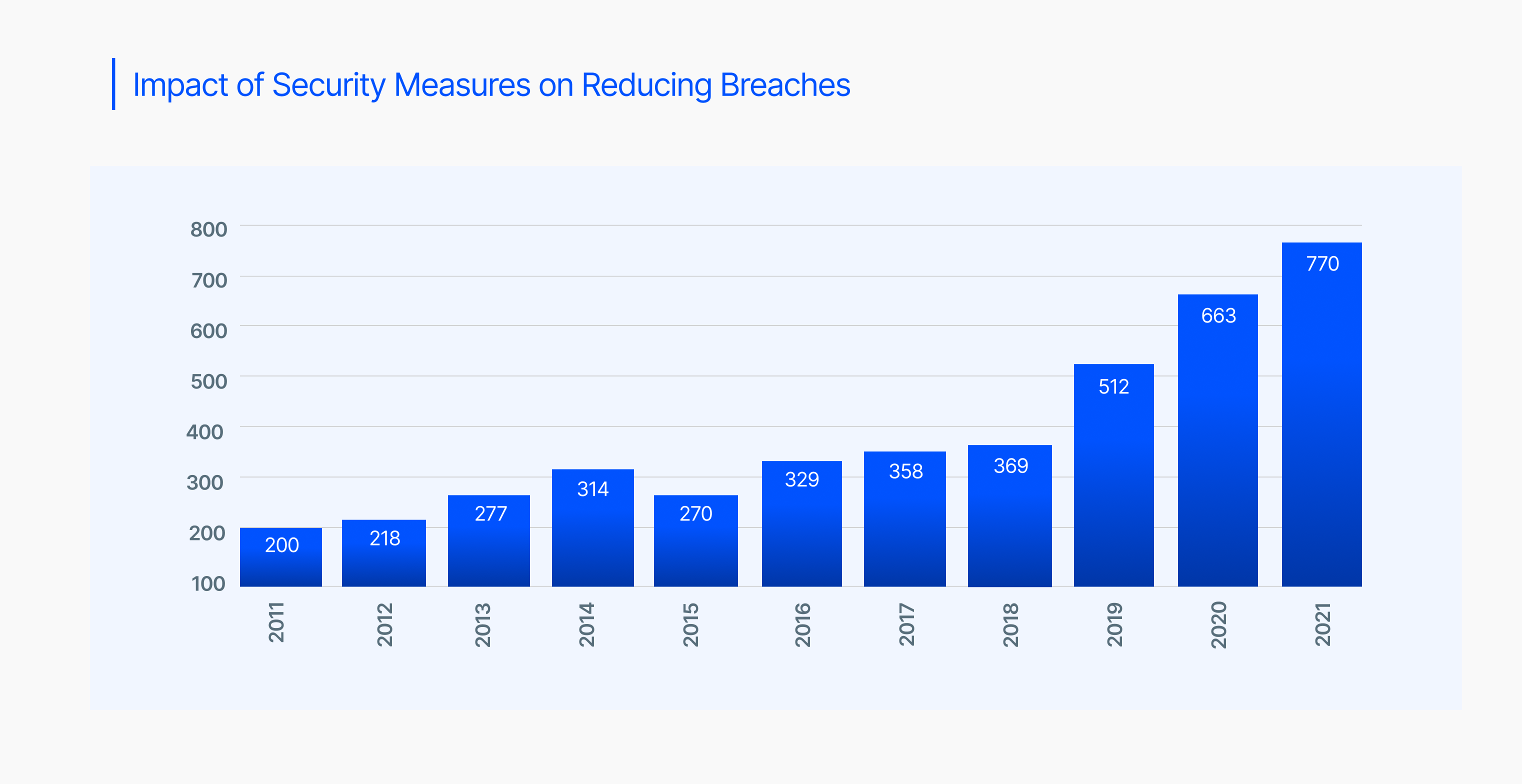

Cybercriminals are on the hunt these days. There’s no scale and type of business that’s spared their viciousness—from tech behemoths to startups, all have been targeted in one way or another. The situation has worsened, especially in the last few years, with threat actors on the loose, inflicting unspeakable damage to organizations globally.

The threat of cyberattacks looms large for the finance industry, and a lackadaisical approach from top financial institutions could lead to a dead end, with consequences including massive financial losses, disruption of critical services, and erosion of customer trust.

Why financial institutions are major targets

Owing to enormous amounts of sensitive data they hold, financial institutions are the key targets for cybercriminals. This data includes personal information, financial data, and intellectual property.

A data breach or cyberattack can have a ripple effect, causing:

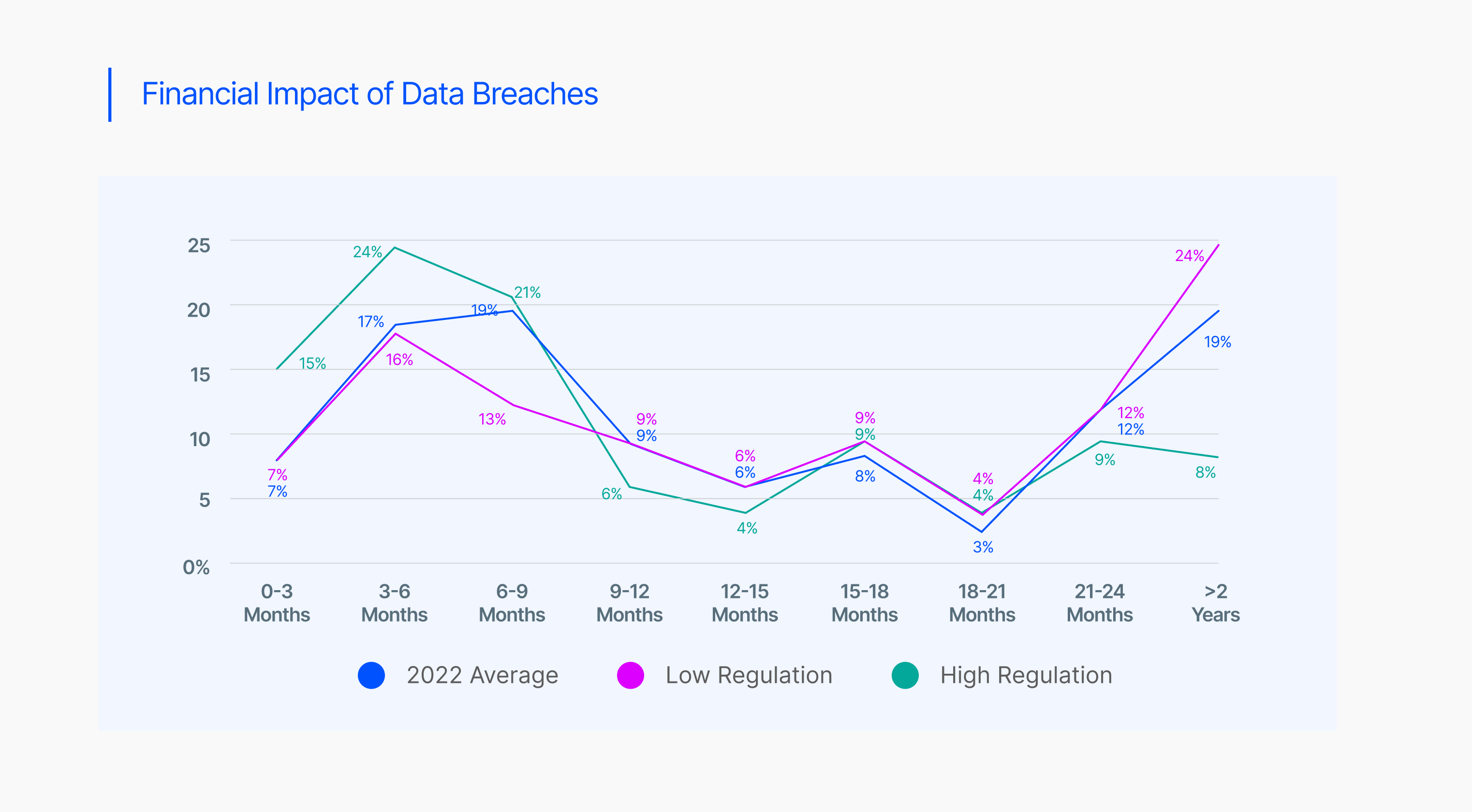

- Financial losses:Stolen funds, fraudulent transactions, and the cost of remediation can be crippling for financial institutions. According to an article published in Cybercrime Magazine, cybercrime is set to cost the world $10.5 trillion annually by 2025.

- Disrupted services:Cyberattacks can cripple online banking services, making it impossible for customers to access their accounts and conduct transactions.

- Erosion of trust:When a financial institution experiences a data breach, it can severely damage its reputation and erode consumer trust.

Threat actors outsmart organizations

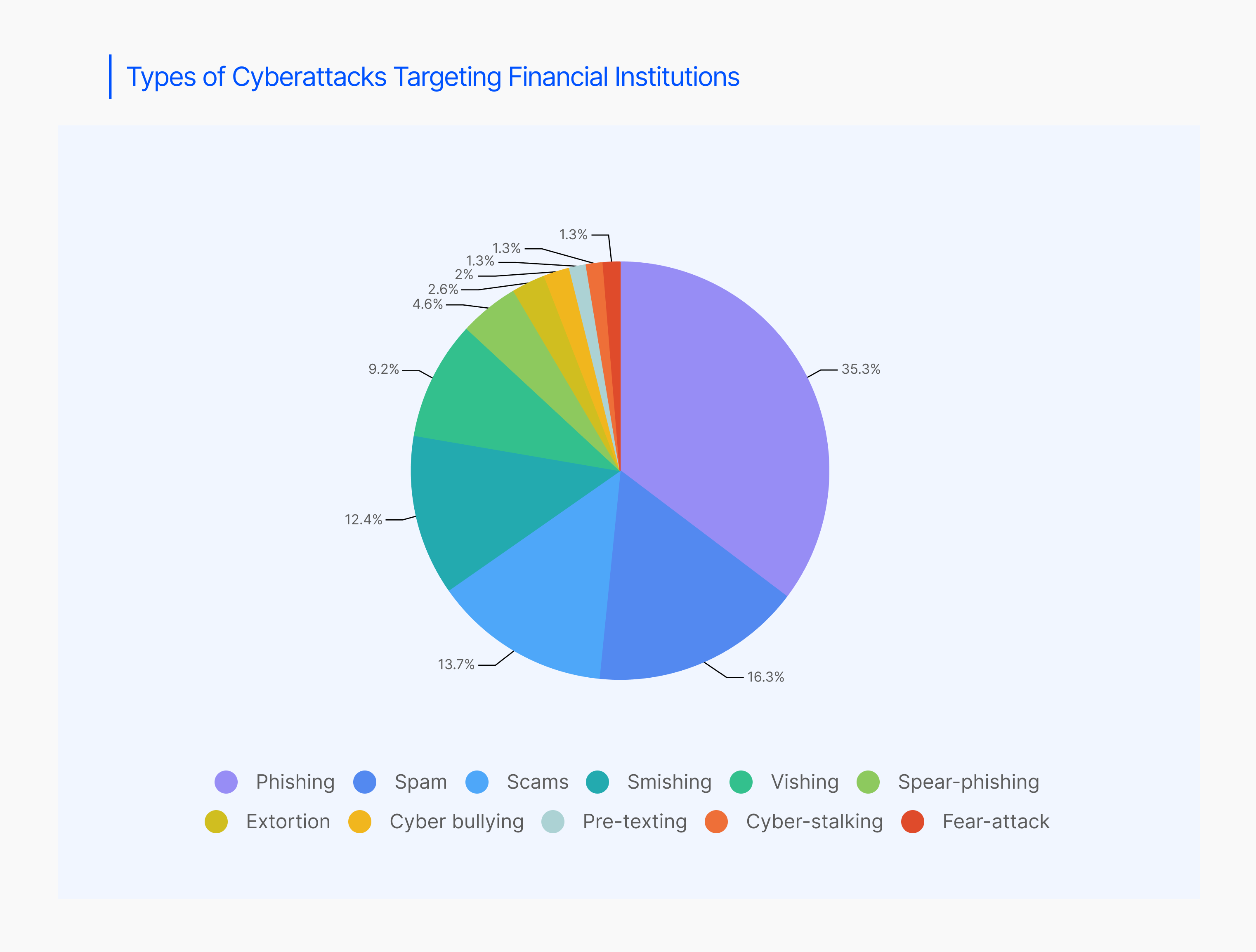

Cybercriminals are constantly developing new and sophisticated methods to attack financial institutions. Here are some of the most common threats:

- Phishing and social engineering:These attacks attempt to trick employees into revealing sensitive information or clicking on malicious links that can download malware.

- Malware and ransomware:Malware can steal data or disrupt operations, while ransomware encrypts critical data and demands a ransom payment for decryption.

- Distributed denial-of-service (DDoS) attacks:These attacks overwhelm a system with traffic, making it unavailable to legitimate users.

- Advanced persistent threats (APTs):These are highly targeted attacks perpetrated by skilled hackers who can maintain access to a system for extended periods.

- Insider threats:Disgruntled employees or contractors can pose a significant security risk by stealing data or sabotaging systems.

A multi-layered approach is key

Financial institutions need to take a multifaceted approach to cybersecurity. For example, they should implement strong access controls by using multi-factor authentication and limit access to sensitive data based on the principle of least privilege. Regularly training employees on cybersecurity best practices to spot and avoid phishing attempts and social engineering tactics is also very important. Besides, financial institutions would immensely benefit from investing in security technology by implementing firewalls, intrusion detection systems, and data encryption to address vulnerabilities. Most importantly, they must comply with a variety of cybersecurity regulations that mandate minimum security standards.

An ongoing battle

Cybersecurity is a potent threat not just for the financial sector but for all industries. As technology evolves, so too cybercriminals. The key, therefore, lies in staying ahead of the curve and investing in robust security measures. To this end, there should be an increased focus on artificial intelligence (AI) and machine learning (MI), empowering financial companies to detect anomalies in network traffic and identify potential cyberattacks.

Secondly, there should be greater emphasis on cloud security. As financial institutions move more operations to the cloud, they need to ensure that cloud providers have robust security measures in place. More crucially, collaboration is essential to share threat intelligence and develop effective strategies to combat cybercrime.

Conclusion

If you want to grow your wealth with a positive impact on the planet, there’s no better option than sustainable investing. This allows you to align your investments with your values by conducting thorough research to identify compelling opportunities that contribute to a more sustainable future. Sustainable investing is not a destination—it’s a journey, one that might take longer than you expect. Stay informed, continually evaluate your investments, and adapt your portfolio as the landscape evolves.