Identifying Sustainable Investment Opportunities

The world is undergoing a massive shift towards sustainability. Consumers are demanding eco-friendly products, governments are implementing tougher environmental regulations, and investors are increasingly seeking opportunities to align their portfolios with a sustainable future. This trend presents exciting possibilities for those looking to invest in companies making a positive impact.

What is sustainable investment?

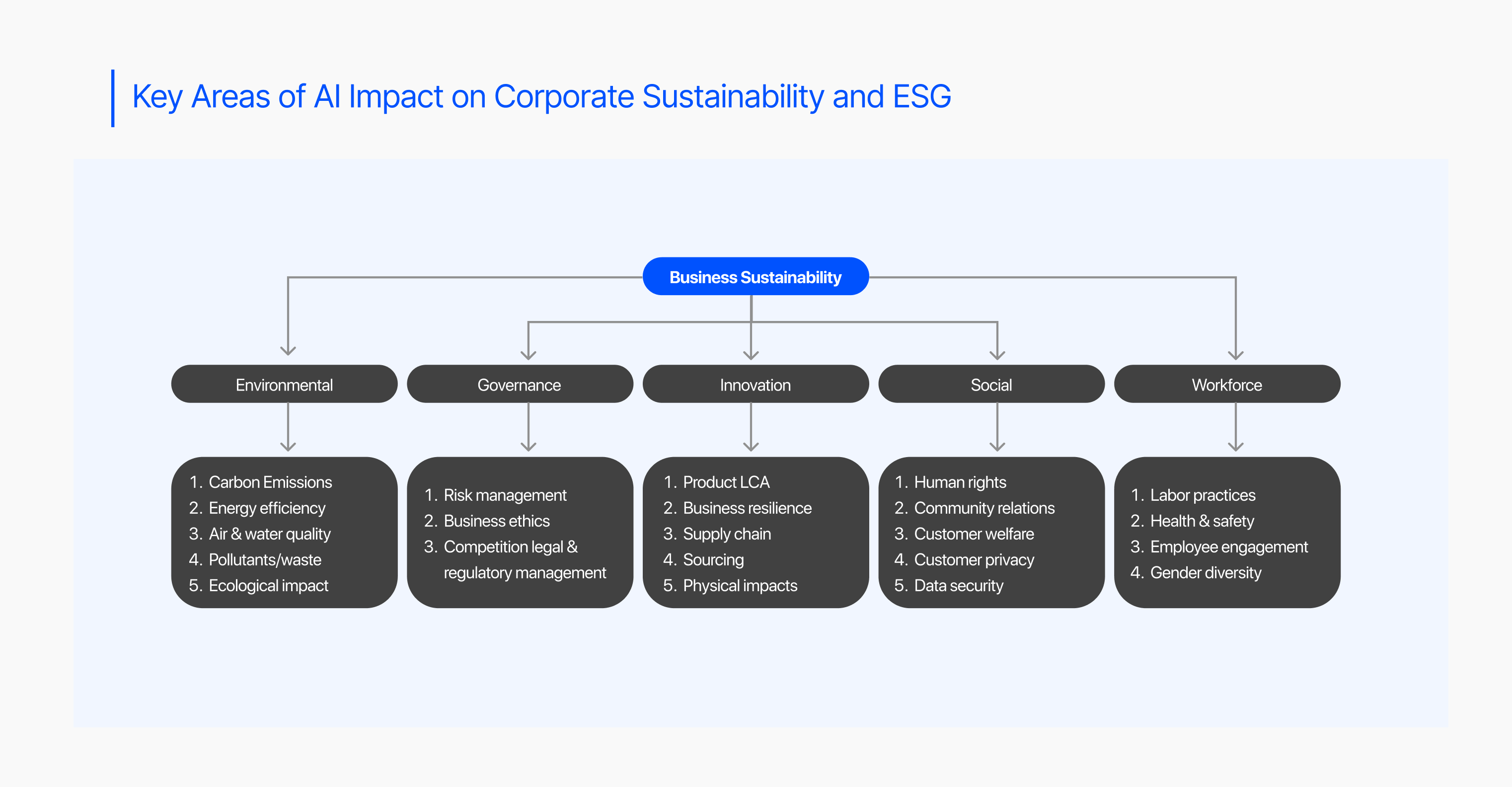

Sustainable investing goes beyond just financial returns. It incorporates Environmental, Social, and Governance (ESG) factors into the investment decision-making process. This means considering a company's environmental footprint, its social impact on communities and employees, and its corporate governance practices.

There's a misconception that sustainable investing means sacrificing returns. However, a growing body of research suggests otherwise. According to a 2020 study by Morgan Stanley, "sustainable investing approaches can deliver competitive returns while mitigating downside risk". A recent report by the same institution highlighted that "sustainable funds outperformed their traditional peers across all major asset classes and regions in 2023".

Offering a wide range of options

The sustainable investment landscape offers a diverse range of options to suit different risk appetites and investment goals. Renewable energy, for one, is driving significant growth in renewable energy sources like solar, wind, and geothermal. Investing in companies developing and deploying these technologies represents a compelling opportunity. For instance, The Wall Street Journal recently highlighted the potential of battery storage technology, a crucial component for integrating renewables into the grid.

Beyond energy generation, a number of companies are innovating in clean technologies that address environmental challenges. This could include companies developing solutions for water treatment, waste management, and sustainable agriculture. And investments in sustainable infrastructure projects, such as energy-efficient buildings, smart grids, and sustainable transportation systems, are crucial for building a greener future. These projects often offer stable returns with a positive environmental impact.

Glut of investment options

With the growing popularity of sustainable investing, numerous investment options are available. Here are some tips to navigate the landscape:

- Define your sustainability goals:What environmental or social issues are most important to you? Align your investments with your values.

- Do your research:Analyze companies' ESG practices and track records. Reputable sources like Morningstar and MSCI ESG Ratings offer valuable insights.

- Consider investment vehicles:Options include individual stocks, sustainable mutual funds, and exchange-traded funds (ETFs) that focus on ESG criteria.

Benefits

There are several compelling reasons to consider sustainable investing:

- Align your portfolio with your values:By investing in companies making a positive contribution to the world, you can align your portfolio with your values.

- Potential for competitive returns:Sustainable companies are well-positioned for long-term growth in a changing world.

- Mitigate risk:ESG factors can help identify companies exposed to environmental or social risks that could impact their financial performance.

Conclusion

If you want to grow your wealth with a positive impact on the planet, there’s no better option than sustainable investing. This allows you to align your investments with your values by conducting thorough research to identify compelling opportunities that contribute to a more sustainable future. Sustainable investing is not a destination—it’s a journey, one that might take longer than you expect. Stay informed, continually evaluate your investments, and adapt your portfolio as the landscape evolves.