AI and the Future of Equity Research

The world of equity research is poised for a major transformation. Artificial intelligence (AI) is gaining ground quickly and envisions a time when machines can analyze enormous information and produce insights at remarkable speeds. Will AI completely replace human analysts? The answer is a resounding "no."

Our future is more likely to be one of "Man + Machine," where human knowledge and artificial intelligence (AI) combine to provide a more sophisticated and potent method of stock valuation. Traditionally, equity research has relied heavily on human analysts sifting through financial statements, news articles, and company filings. While valuable, this process can be time-consuming and prone to human bias. AI, however, excels at processing enormous quantities of data and identifying patterns that might escape the human eye.

AI no silver bullet

A recent study by the National Bureau of Economic Research (NBER) highlights this advantage. Their AI analyst, trained on corporate financials, qualitative disclosures, and macroeconomic indicators, demonstrated an ability to outstrip human analysts in stock price forecasts, particularly for companies with complex structures and a high volume of public information. However, the NBER study also reveals a crucial point: AI is not the silver bullet.

When the information becomes less transparent or requires an understanding of "soft factors" like company culture or industry dynamics, human analysts regain the upper hand. This is because AI struggles with qualitative data and the ability to synthesize complex narratives.

Embracing man+machine approach

This is where the "Man + Machine" approach comes in. Imagine an "analyst centaur," a hybrid of human expertise and AI power. By combining AI's data-crunching abilities with the human capacity for critical thinking and "reading between the lines," we can unlock a whole new level of insight.

A 2021 article in the Harvard Law School Forum on Corporate Governance cites research demonstrating that combining human forecasts with AI models led to superior performance compared to either on its own. This suggests that the future of equity research lies in collaboration, not competition.

So, what does this mean for the future of human equity analysts? The answer is not job displacement, but rather a shift in focus. Analysts will likely move away from the mundane task of data processing and towards a more strategic role, leveraging AI-generated insights to delve deeper into a company's story and identify hidden opportunities.

This future requires a new breed of analyst: one skilled in working with AI tools, interpreting their outputs, and integrating them with their own judgment and experience. Analysts will need to become experts not just in finance, but also in data science and understanding the limitations and biases of AI models.

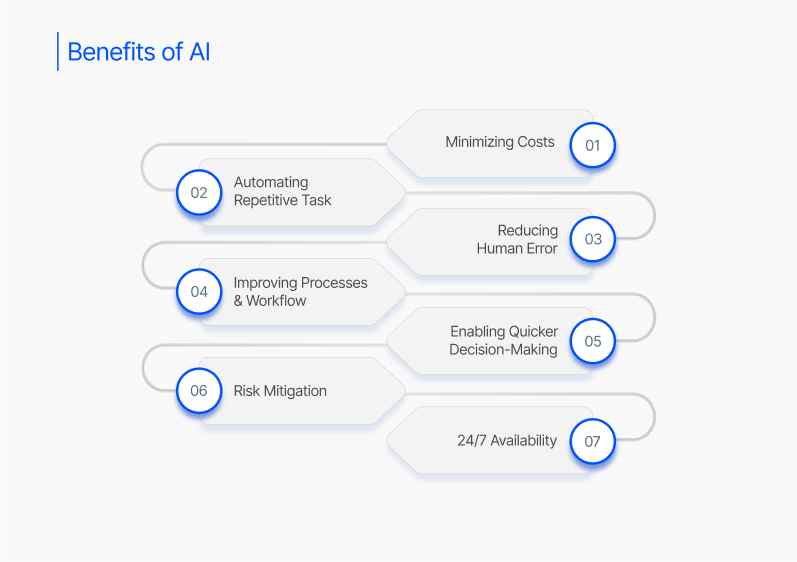

The benefits of this collaborative approach extend far beyond increased accuracy. AI can automate repetitive tasks, freeing up analyst time for more valuable activities like in-depth company visits, competitor analysis, and client interaction. This can lead to a more personalized and insightful research experience for investors.

Challenges abound

Of course, challenges remain. There’s an urgent need for addressing ethical considerations surrounding AI bias and the "black box" nature of some models. Ensuring data quality and preventing manipulation will also be crucial for maintaining trust in AI-driven research.

However, the potential benefits of AI in equity research are undeniable. By embracing a "Man + Machine" approach, analysts can unlock a new era of financial insight, leading to better investment decisions and a more efficient market. As a 2023 article in IR Magazine suggests, the future belongs to those who can harness the power of both human and artificial intelligence.

Conclusion

If you want to grow your wealth with a positive impact on the planet, there’s no better option than sustainable investing. This allows you to align your investments with your values by conducting thorough research to identify compelling opportunities that contribute to a more sustainable future. Sustainable investing is not a destination—it’s a journey, one that might take longer than you expect. Stay informed, continually evaluate your investments, and adapt your portfolio as the landscape evolves.