Building a Holistic Client Profile: An Advisor’s Guide for Effective Financial Planning

Financial planning is crucial as it enables an advisor to determine how an investor will achieve its objectives and strategic goals. However, it is not a one-size-fits-all solution — each client’s financial situation matters. Far beyond engaging in number-crunching, advisors need to get to the heart of a client’s profile if a truly effective plan is to be crafted. This is where building a holistic client profile comes in.

Why a holistic approach is important

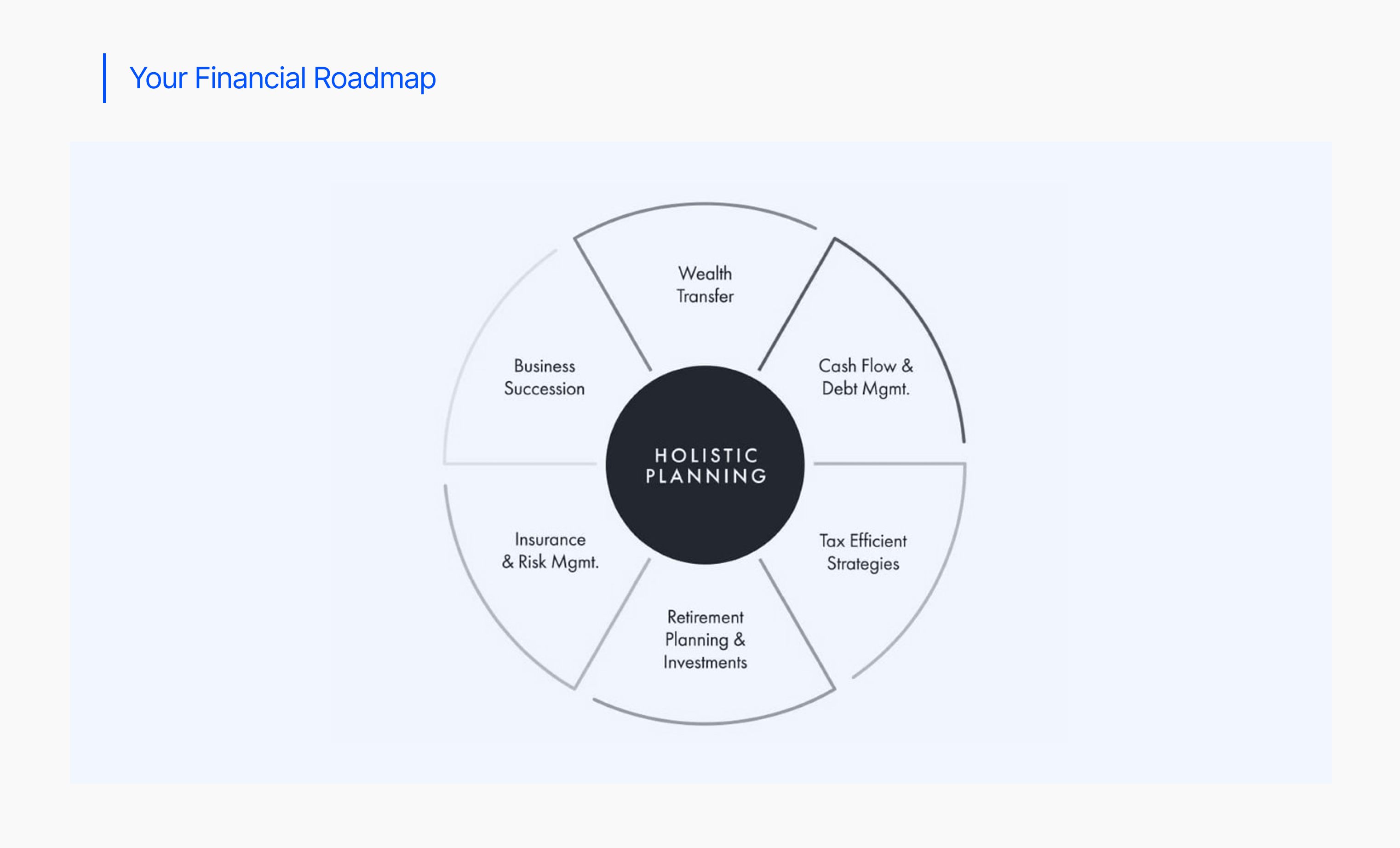

Can you imagine a doctor treating their patient without taking into account the entire medical history? Certainly not, right? The same goes for financial planning. Focusing merely on investments or retirement savings overlooks the bigger picture. A holistic approach, as advocated by prestigious financial planning organizations like the National Endowment for Financial Education (https://www.nefe.org/about/default.aspx), considers all aspects of a client's financial life, painting a complete picture.

Building your client's financial fingerprint

So, what goes into building this comprehensive profile? Here are some key areas to explore:

- Financial fundamentals: This encompasses income sources (salary, rental income, etc.), expenses (fixed and variable), debts (mortgages, student loans), and current assets (savings, investments, property). Tools like budgeting apps and cash flow analysis can help collect this information.

- Risk tolerance: It’s crucial to understand a client’s comfort level with risk. One should see whether they are conservative or more aggressive. Risk tolerance questionnaires can be a valuable resource here.

- Life goals: Consider your client’s long-term and short-term goals: whether they long for a comfortable retirement, seek to establish a business, or plan to travel the world. Since money is a tool to achieve one’s dreams, understanding these aspirations helps tailor the plan accordingly.

- Values: Financial decisions are often associated with core values. Advisors should see whether it’s financial security that clients are most concerned about or is it passions like philanthropy that they are willing to take some risks for. Understanding their values helps guide investment choices and spending strategies that are in step with their beliefs.

- Family dynamics: Marital status, dependents, and potential future inheritances all play a role. Estate planning and insurance needs will vary depending on a client's family situation.

- Health considerations: Financial planning can be severely impacted by pre-existing medical conditions or a family history of disease. It’s essential to factor in adequate health insurance and potential long-term care needs.

Building rapport is key

Building a holistic profile is not just about assembling data; it’s all about building trust and rapport with your client. And for this, a few things are very important. One of them is active listening, which entails asking your client open-ended questions and truly listening to their answers. Clear communication — which involves explaining financial concepts in clear, concise language — is also very important. Empathy and understanding, as well as a collaborative approach, are equally crucial.

How holistic profile benefits you

Building a comprehensive client profile offers several benefits, including tailored strategies, increased client confidence, and stronger client relationships. After all, clients who feel heard and given importance are more likely to feel confident in their financial future.

Enabling clients build a secure future

Financial planning, though a complex endeavor, can help advisors develop effective strategies that eventually empower their clients to achieve their financial goals only if a holistic approach is adopted to do so. It’s worth remembering that it's not just about the numbers; it's about helping them build a secure and fulfilling future. As an article in Forbes puts it, "There's more to financial planning than just picking stocks and bonds."

Share With