How to Control Your Spending and Save Money

Every day, we pay for numerous commodities we use. Some of these are essential, such as staple food, while some are considered luxuries, like dining in a five-star restaurant. While spending on luxury goods and fine dining are OK once in a while, the problem comes when we lose track of the balance between our expenditure and earnings. This results in our depleting all our income — which means zero savings — or falling into a vicious debt trap.

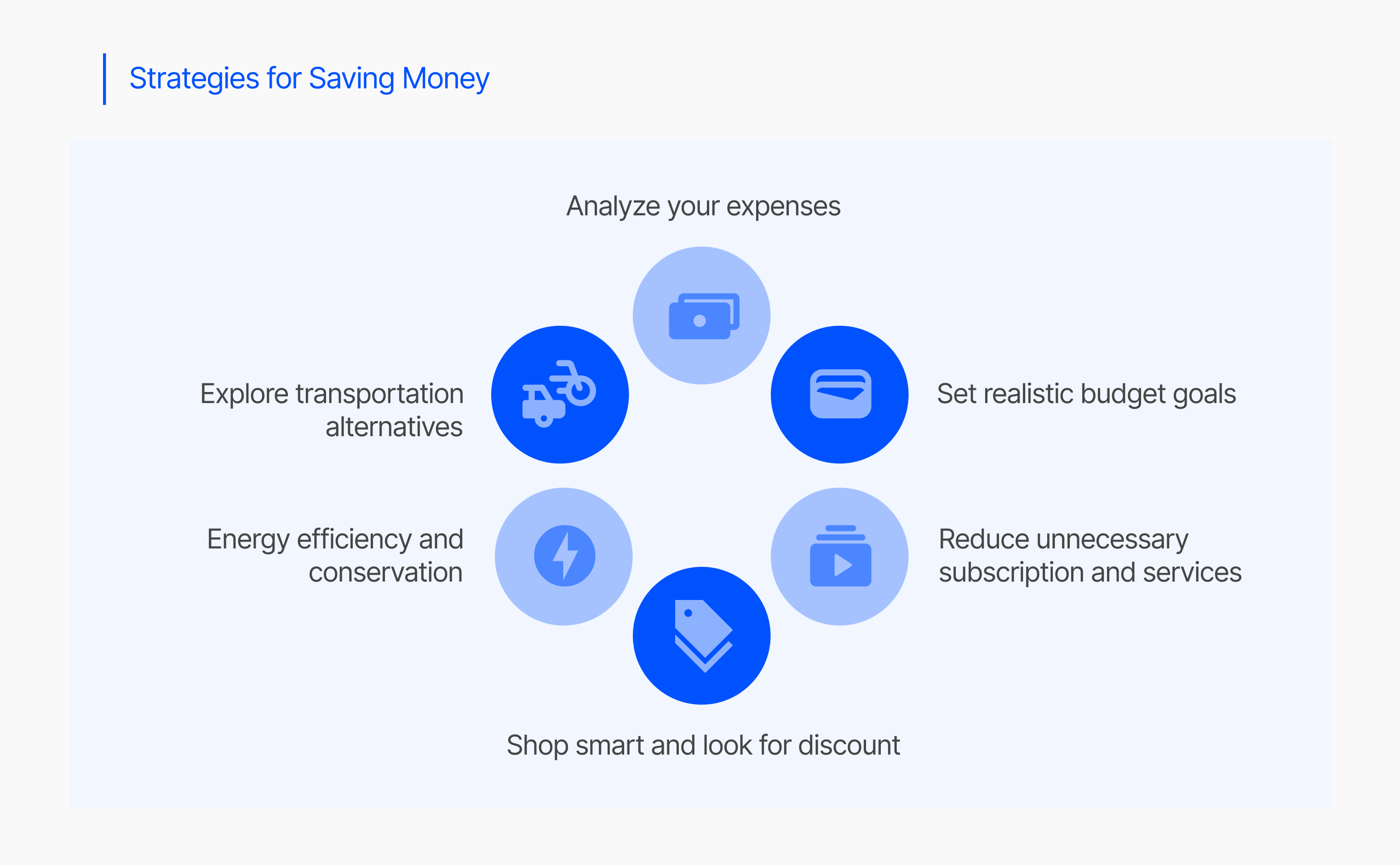

So, how can we control our overspending habits while also conveniently meeting our needs? Here’s what you need to do:

Organize Your Financial Records

Organizing your financial records is the first and the most significant part of budgeting. Without this step, we will never know when and where our money goes. These records can simply be hand-written in a personal diary or typed in ‘Notes’ in our cellphones at the end of every day. Another way to record expenditure could be by using applications like www.mint.com. These innovative apps are super-easy and time-saving. Moreover, you will be surprised as to how much money could’ve been saved had some unnecessary purchases been avoided.

Categorize Purchases

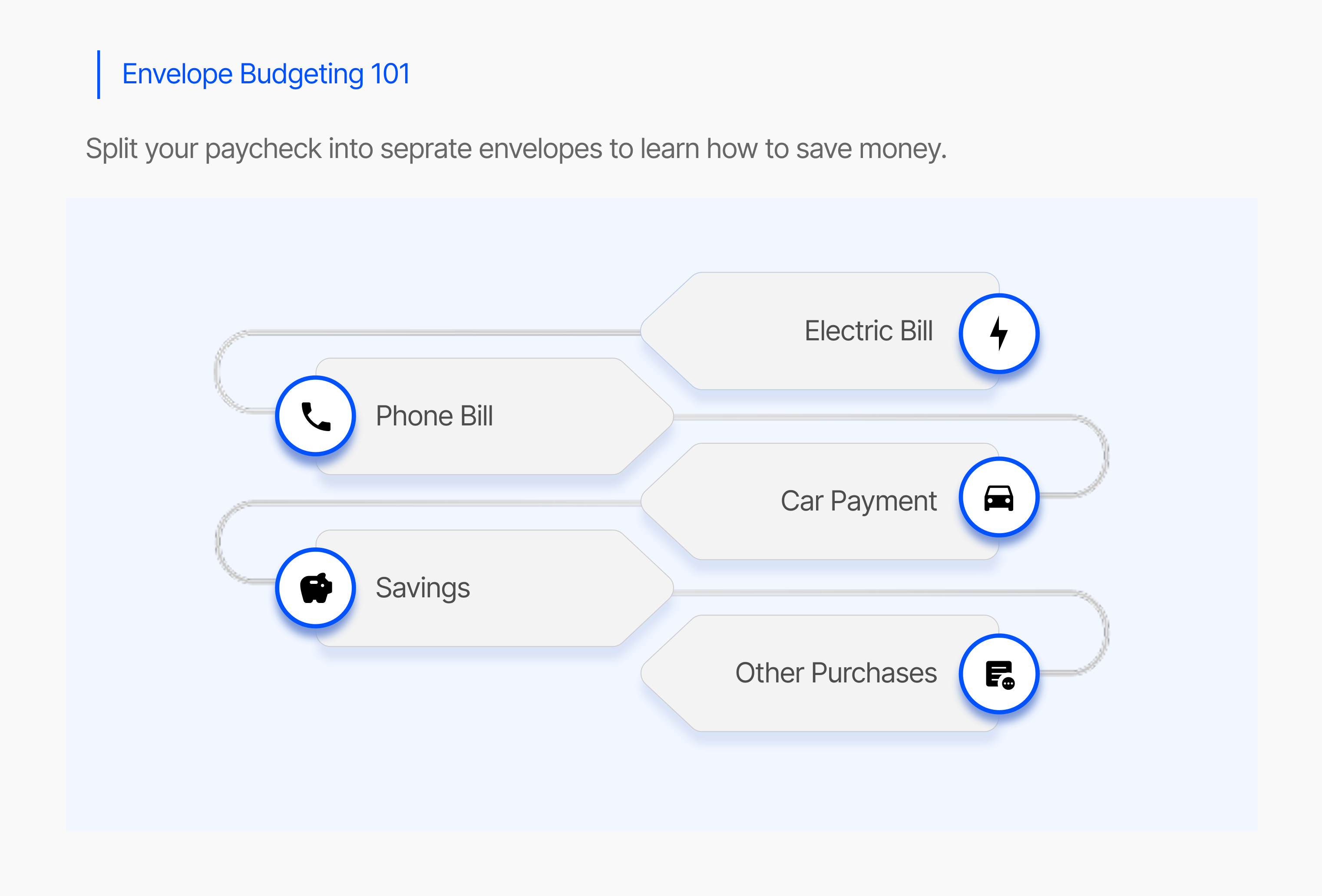

Categorizing each purchase you make is another essential feature of budgeting. You should ask yourself whether or not you want a certain purchase. Was it worth the price? Could it have been avoided or delayed? Answering these questions will help you end up with two categories: 1) your needs without which you can’t survive, and 2) your wants that simply constitute your never- ending desires. After completing this step, reduce your ‘wants’ list and see the change in your savings.

Minimize the Use of Payment Cards

In his compelling article published in 1999 , Prof. Drazen Prelec terms credit cards as being “insidious”, saying that “when you’re consuming, you’re not thinking about the payments, and when you’re paying, you don’t know what you’re paying for.” Studies also show that using cards can lead to higher spending compared to cash. Minimizing the use of such payment methods can help you keep your head above water, saving you from potential bankruptcy. But why should you insist on using these cards sparingly?

When we use debit and credit cards, we may be tempted to spend more than we planned. For example, when you go out to buy a new dress with Rs. 5,000 in your wallet, you will do your best to buy something within this range. In contrast, if you have a payment card, you may get carried away and purchase a dress exceeding your budget simply because you like it. This will derail your planning, causing you to lose control over spending.

The Takeaway

While budgeting can be a challenging undertaking, you can keep your spending habits under control by implementing these three simple techniques. Make these practices a part of your daily routine to witness a positive impact on your financial well-being.

Share With