How to Get Out of Debt and Achieve Financial Freedom

Those who have been in debt must have experienced its crippling effects: an unceasing cycle of burden that only grows heavier with time. But make no mistake: debt is an inescapable monster that one must face at some point in life. Nevertheless, if you modify your spending limits and desist from needless expenses, you can easily shun debt that can feel like a crushing weight, especially when you are unable to pay it, impacting your mental health and your capacity to save for the future.

According to moneysmart.gov.au, “owing money or falling behind on repayments can be stressful. The good news is there are steps you can take to get out of debt — and stay out of debt.” Here are some easy ways you can do that.

1. Understand Your Debt Situation

The first step, which is often the most difficult, is to honestly assess your situation. Compile all of your financial information, such as credit card statements, loan details, and any other outstanding balances. Make a detailed list of all of your debts, along with the interest rates, minimum payments, and total amounts owed. A number of free online tools and apps can help you combine this information and create a clear picture of your debt.

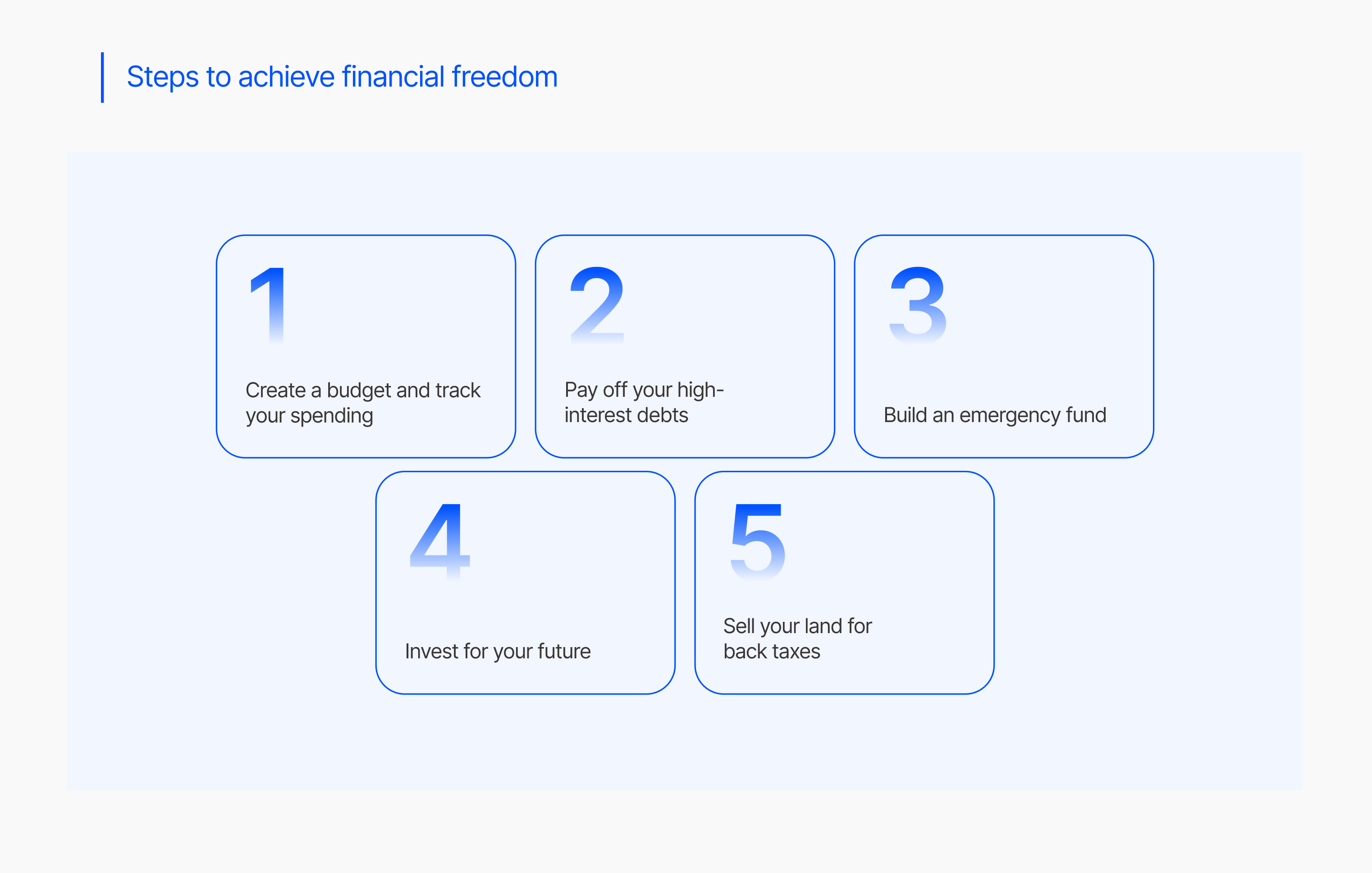

2. Create a Realistic Budget

A budget plays a key role in devising any debt repayment strategy, so track your income and expenses carefully. This will tell you where your money is being spent and how you can cut back on your expenses, such as on dining out and unnecessary subscriptions. The Financial Planning Association (FPA) offers resources and advice on budgeting and financial management.

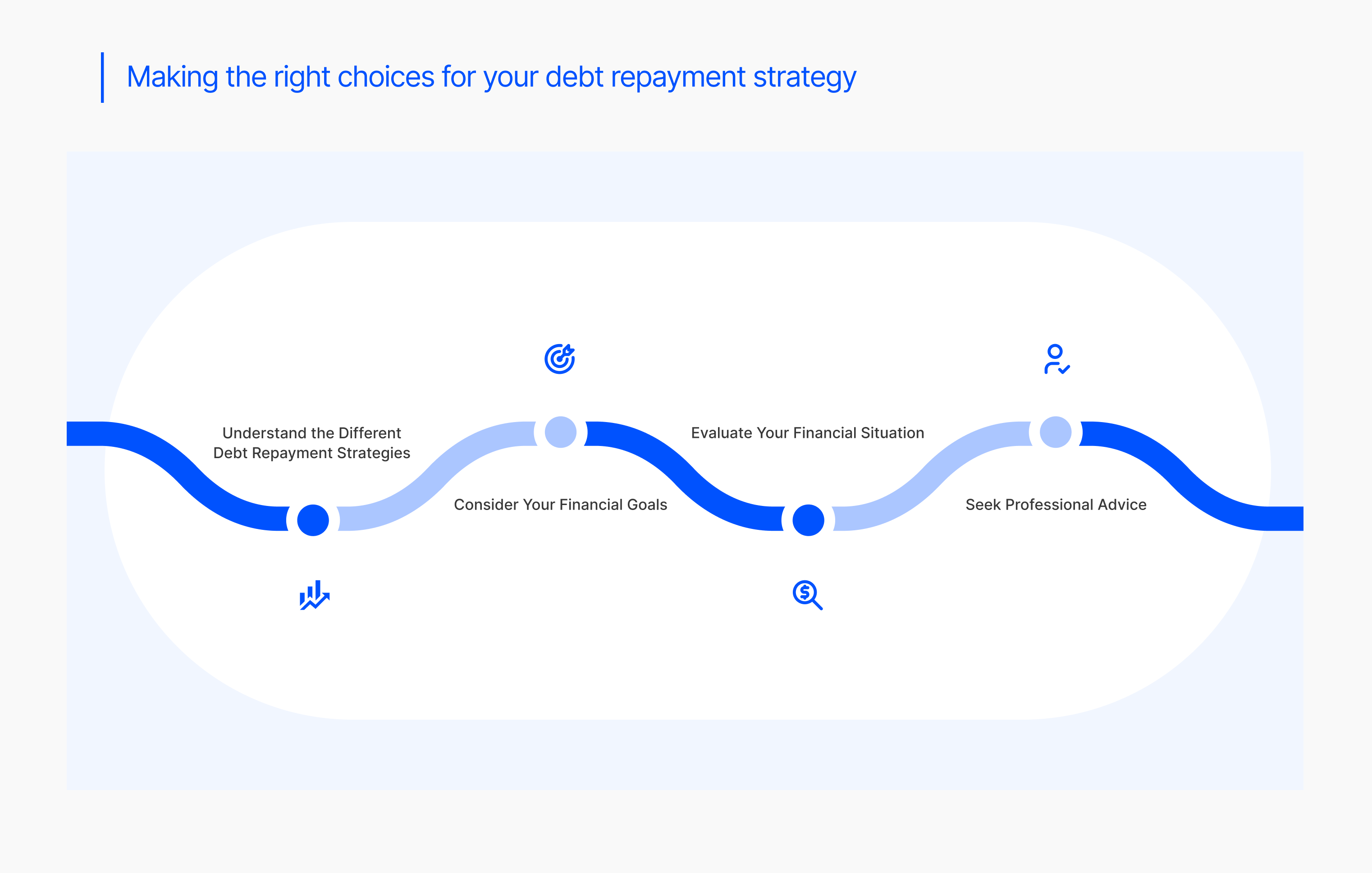

3. Choose a Debt Repayment Strategy

A number of methods can help you deal with your debt effectively, including the debt snowball and the debt avalanche methods, the two most popular approaches. Debt snowball focuses on paying off the smallest debt first, regardless of interest rates. Debt avalanche, on the other hand, prioritizes paying off debts with the highest interest rates first, saving the most money in the long run.

If you need quick wins to stay motivated, the snowball method might be a good fit. If you're more focused on long-term savings, the avalanche method could work tremendously well.

4. Explore Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single loan, simplifying your payments and potentially saving you money. But it’s crucial to research meticulously and comprehend the terms and conditions before consolidating. According to MNP Debt, while there are several debt consolidation options, the best option hinges on your financial situation and other factors such as credit score and income stability.

That budgeting and debt repayment are important goes without saying. However, to speed up your progress, increasing your income is even more important. And the best way to do that is taking on a side hustle, such as freelancing or anything else that can supplement your income. Your goal should be to pay off your debt quickly — even small increases in income can make a big difference.

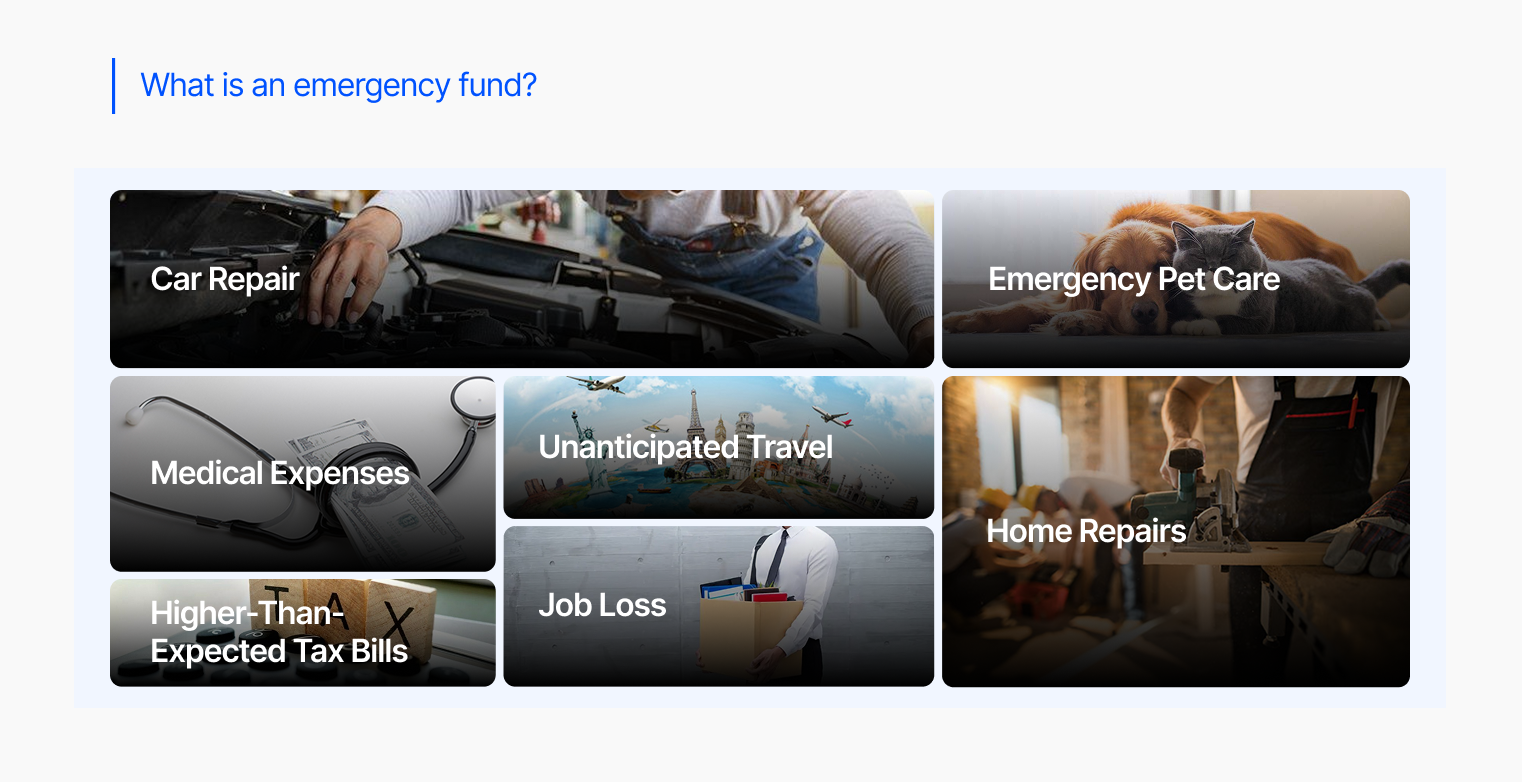

6. Create an Emergency Fund

Establishing an emergency fund is essential after debt repayment; this will help you prevent recurrent debt when unforeseen costs arise. In an easily accessible account, try to save at least three to six months' worth of living expenses. This safety net will shield you from financial shocks and provide you peace of mind.

Conclusion

Getting out of debt is a huge achievement, but staying out requires constant effort. The key to your ultimate financial success lies in continuously budgeting, tracking your spending, and living within your means. Be prudent about your spending habits and steer clear of impulsive buying. In this context, the 50-30-20 rule can be the best practice to follow, which helps you break free from the vicious debt burden and achieve lasting financial freedom.

Share With