How Industry Disruption Impacts Company Valuations

Why some companies rise in value and others slip into oblivion doesn’t simply have to do with luck or random chance. It has more to do with the vibrant world of industry disruption.

In today's volatile business landscape, new technologies have transformed the way industries operate, with cutting-edge business models and shifting consumer priorities making the greatest impact. The result? A profound effect on company valuations that often reshape entire markets in the process.

According to Harvard Business School, identifying untapped opportunities is at the core of innovation, for it can enable you to strategize for sustained success in a competitive landscape, regardless of your industry.

What is Industry Disruption?

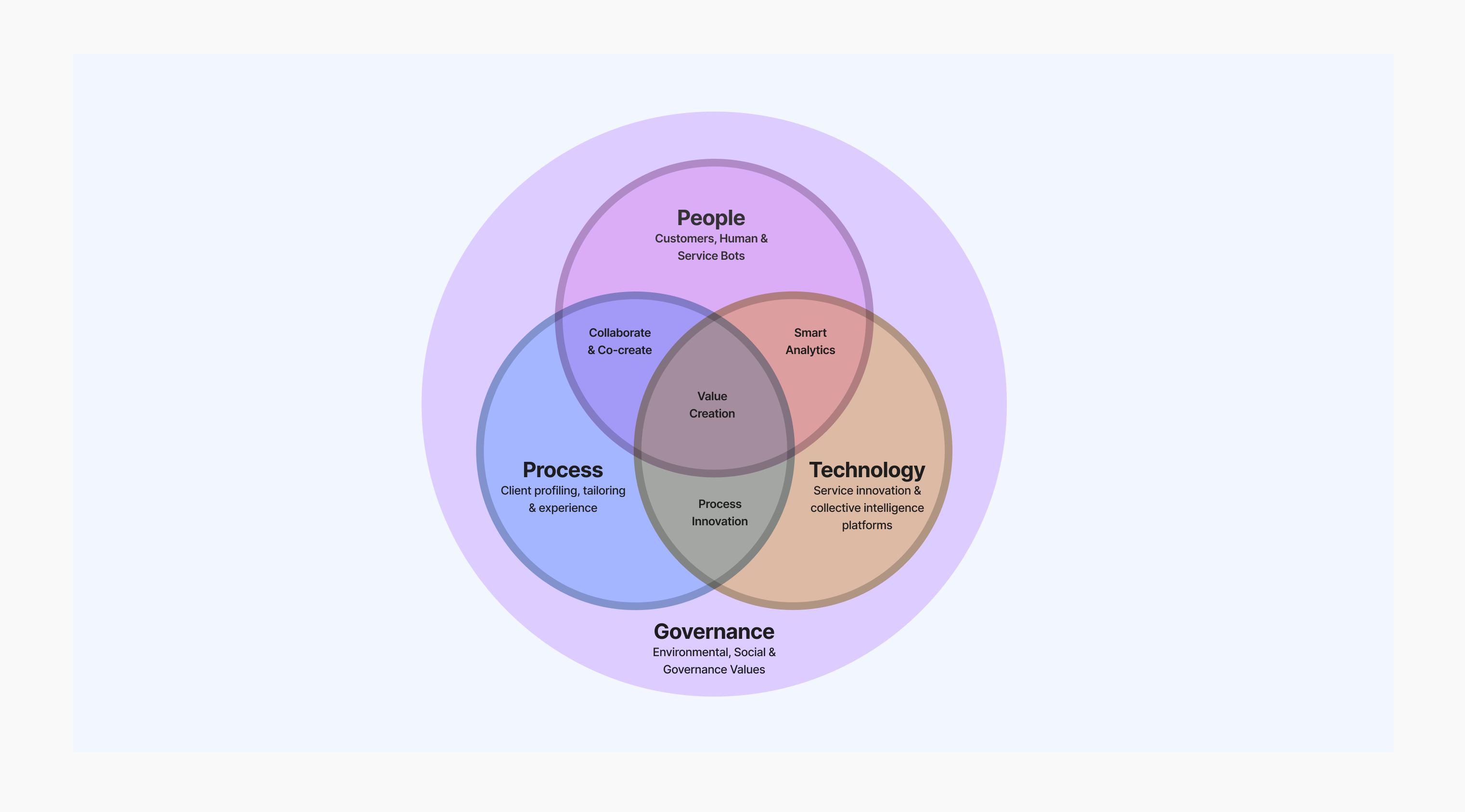

Industry disruption refers to significant changes that often result from technological advancements, changing consumer preferences, or other factors. Capable of altering the current market landscape, industry disruption affects the way companies operate and compete with one another. In the context of company valuations, industry disruption can have a substantial impact on the perceived value of a business.

For instance, a company operating in a disrupted industry may struggle to sustain growth or may encounter falling market share, resulting in a drop in its valuation. The situation is, however, favorable for companies capable of innovation and adapting to shifting circumstances, leading to higher valuations due largely to their ability to capitalize on new market opportunities.

Company Valuations: An Overview

Company valuations serve as a crucial factor in assessing a company’s value in the market. It reflects investors' confidence, growth potential, and overall financial health of the organization. A number of factors contribute to company valuations, including revenue, profit margins, market share, and growth prospects. Also, industry disruption can greatly impact these valuations.

If businesses in disrupted industries don't adjust to the shifting dynamics of the market, their valuation can drop. Conversely, firms that effectively manage industry upheaval by inventive approaches and calculated adjustments frequently witness a rise in their market values. Thus, in order for investors and other stakeholders to make informed decisions regarding the potential value and prospects of a firm, they must understand and appropriately analyze company valuations.

Factors Influencing Company Valuations

An article published in Harvard Business Review has identified six critical factors that account for most of the variability in market valuations. These can be used by management teams to build a nearly universal model that enables them to compare businesses within the same industry, businesses across industries, and businesses within industries. Additionally, the approach can assist executives in comprehending how the market's valuation of any of these organizations evolves over time.

- Weighted forecasts of growth in company revenue

- Weighted forecasts of growth in company margin

- Patterns of cash returned to shareholders

- Changes in the company’s debt-to-equity ratio

- The economic conditions in the company’s industry

- Market volatility in the geographic areas in which the industry’s major companies compete

Technology Disruption and Company Valuations

Company valuations are significantly affected by technological change. Adopting and utilizing disruptive technology can help a business grow and become more valuable to the market. Businesses that embrace emerging technology, like blockchain or artificial intelligence, for example, frequently beat their rivals. In contrast, companies that fall behind on technology-related developments risk having their values drop or perhaps becoming obsolete.

Regulatory Changes and Company Valuations

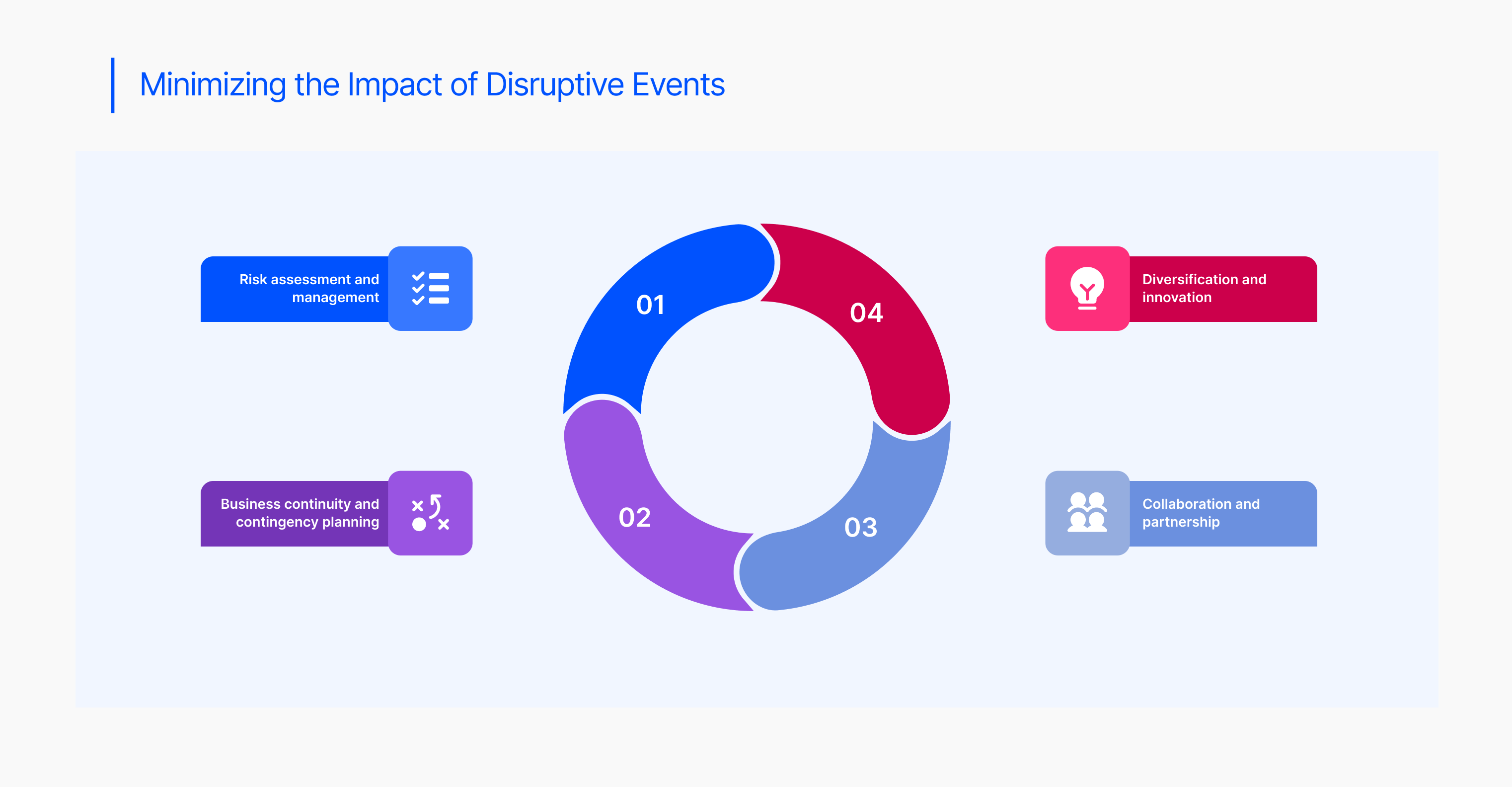

Regulatory changes significantly affect company valuations. The market value of industries that are subject to stringent restrictions frequently varies as a result of modifications to governmental rules and compliance standards.

For instance, the value of businesses that rely significantly on fossil fuels may be impacted by the introduction of new environmental legislation. Conversely, valuable regulatory changes—like the deregulation of some industries — can raise the value of an organization. To reduce risks and seize opportunities, businesses must constantly monitor and adjust to changes in regulations. Companies can better navigate regulatory upheavals and safeguard their valuation by remaining educated and making proactive adjustments to their strategies.

Conclusion

According to an article published in Gatekeeper, regulatory changes have a massive impact on the financial services industry, influencing compliance, risk management, consumer protection, and overall operations. While these changes pose significant challenges, they also offer opportunities for financial institutions to boost their operations, reinforce their reputation, and gain a competitive edge. Financial institutions can translate regulatory changes to opportunities for growth and success if they leverage technology, focus on customer needs, and effectively manage risks.

Share With