How to Avoid Behavioral Biases in Investing

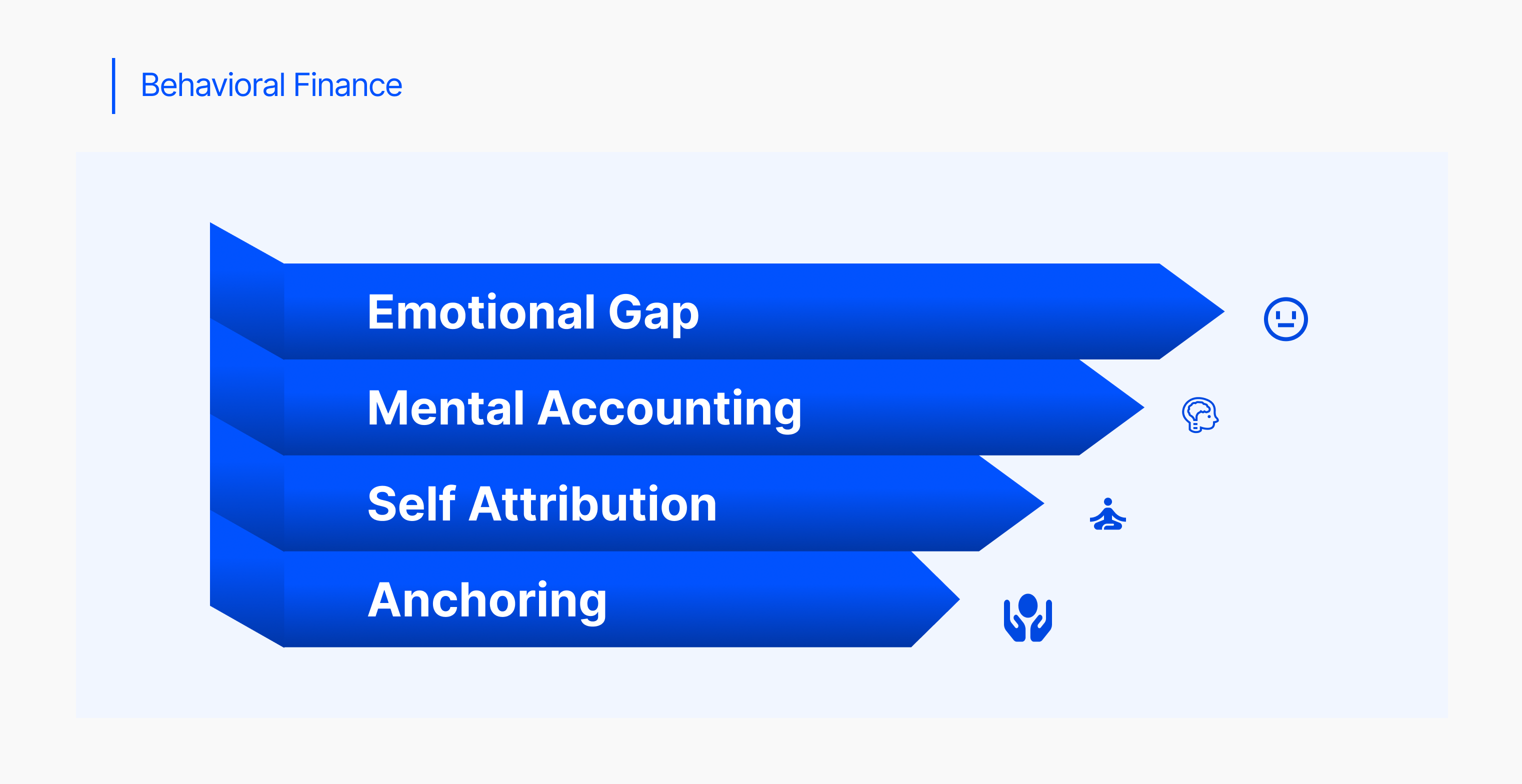

As investors, we all want to make sound investment decisions, but our judgment is often clouded by factors such as deep-seated psychological patterns and emotions. This situation leads to what is typically known as behavioral biases, which subtly influence our choices and cause us to err. Behavioral finance, a field that bridges psychology and economics, delves into these biases, enabling us to become more prudent investors.

To avoid falling into the pitfalls of behavioral biases, understanding the major culprits and exploring strategies to avoid them is crucial.

1. Loss aversion

Loss aversion involves our proclivity to feel the pain of losing more strongly than the pleasure of gaining. This can lead investors to hold onto losing stocks for too long, hoping to avoid realizing a loss on paper, even when the future outlook seems bleak.

But there are ways to beat loss aversion. For example, you can limit potential losses by defining a price point, known as a Stop Loss, at which you’ll automatically sell a losing investment. Secondly, avoid getting fixated on short-term jitters and focus on long-term goals. Embracing diversification, which involves spreading your investments across different asset classes to reduce risk, can also help.

2. Overconfidence

Being confident is a virtue; being overconfident is a sin. This rule applies more strictly to the world of finance and investment. It’s a bitter truth that investors experience overconfidence bias, where they tend to overestimate their knowledge and capabilities. A study published in the Journal of Behavioral Finance found that over 70% of investors believe they're above average in their investing skills.

To curb this negative personality trait, you should thoroughly research potential investments before committing your hard-earned cash. Considering consulting a qualified financial advisor for personalized guidance is also immensely beneficial.

3. Anchoring bias

Our decisions can be profoundly influenced by the initial piece of information we get. For instance, if a stock is trading at $100 and you learn it used to be at $150, you might be more inclined to buy, assuming a rebound is inevitable. This anchoring bias can lead to neglecting key factors that might influence the stock's true value. In a comprehensive research paper titled “The Dark Side of Choice: When Choice Impairs Social Welfare”, authors Sheena Iyengar and Eldar Shafir wrote that people's initial price estimates significantly influence their final willingness to pay.

However, breaking free from anchoring is easy. For one, collect multiple data points and go over historical trends, analyst ratings, and overall market conditions. Secondly, consider opportunity cost, which involves exploring alternative investment options before making a final decision.

4. Herd mentality

As social creatures, we tend to jump on the bandwagon and mimic what others are doing, especially when experiencing uncertainty. This is the herd mentality bias in action. According to Dalbar Associates, the average equity investor underperforms the market by an average of 1.5% annually, partly due to herd mentality.

However, resisting the herd is crucial. Firstly, don’t let popular trends sway you from your long-term investment strategy. Secondly, think independently: do your own research and analysis before making investment decisions. And finally, don’t follow hot stocks simply because everyone else is.

5. Confirmation bias

Successful investors welcome diverse viewpoints and avoid information that reinforces their existing beliefs. But most investors make the terrible mistake of seeking out news and analysis that validate their choices, eventually suffering from confirmation bias.

To become prudent investors, it’s important to snap out of confirmation bias, which entails exposing yourself to divergent views by reading financial news from different sources. You should also be critical of the information you consume while embracing the power of saying “I don’t know.”

The bottom line

Making more informed and rational investment decisions becomes all the much easier if you overcome the aforementioned biases. Patience, discipline, and a commitment to continuous learning are key ingredients for long-term success.