The Impact of Emotions on Investment Decisions

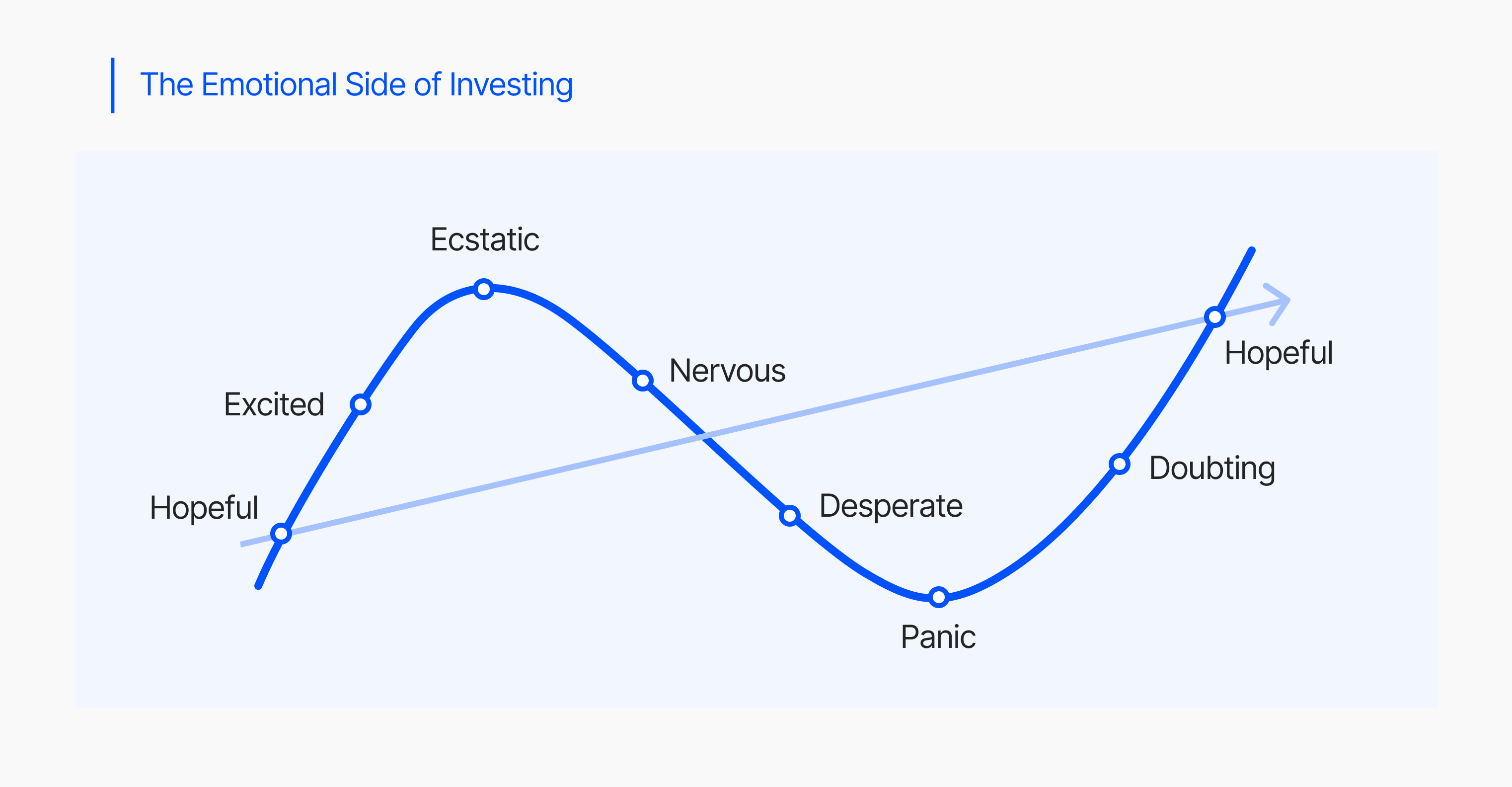

You may be wondering what emotions have to do with investment decisions. For after all, it’s wisdom, stability of nature, and rationality that help anyone — a professional or a layperson — decide how, where, and when to invest. Right? No. There’s no disputing the significance of logic and analysis in financial planning, but the emotional factor can massively influence our choices, sometimes leading to both successes and pitfalls.

An article published in The Wall Street Journal urges investors to “get in touch” with their feelings, suggesting that “even if we think we're being cold and analytical when we make a move, emotions are working under the surface in ways that we can't escape — and usually don't entirely understand.”

Watch your emotions

We are driven by our innate proclivity to seek rewards and shun losses. Known as loss aversion, this tendency sometimes can push an individual to invest irrationally. For instance, although they know that the investment is no longer viable, investors may find themselves unwilling to sell a losing stock, in the hope that it will recover. This behavior actually stems from the fear of regret and the desire to avoid a loss.

Overconfidence is another emotional factor that can lead an individual to invest in dicey stocks. Worse, they are reluctant to own up to their mistakes despite making a bad investment decision. Investors often believe they have a better understanding of the market than they actually do. As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful."

Fear and greed: powerful emotions

The two powerful emotions that all investors experience are fear and greed; in fact, they greatly influence investment decisions. Fear can cause investors to panic and sell their assets during market downturns, even when there’s no fundamental reason for concern. And when they chase after a potentially lucrative stock without considering the risks involved, they are overcome by greed that eventually leads to overvaluation and the formation of bubbles, which can have disastrous consequences. Include a relevant reference and its source in this passage.

The impact of news and media

The media influences every aspect of life today, and it also severely affects investor emotion. Negative news headlines — or breaking news — send an investor into a frenzy of fear and uncertainly, leading to a sell-off in the market. Positive news, in contrast, comes across as a breath of fresh air, fueling optimism and pushing prices higher. An article published in Investopedia suggests that negative news will normally cause people to sell stocks, whereas positive will normally cause individuals to buy stocks. Nevertheless, expecting the media to be positive is like barking up the wrong tree, as it’s often focused on sensationalism or negative news in the battle for ratings.

Managing emotions for good decision-making

While emotions are a natural part of human behavior, developing strategies to manage them and make more rational investment decisions is possible. And you can do that by:

- Diversifying your portfolio

- Setting realistic expectations

- Sticking to a long-term investment plan

- Seeking professional advice

- Practicing mindfulness and meditation

Conclusion

If you want to make informed decisions regarding your investment, underestimating the significance of emotions would be a grave mistake; they are a powerful and impactful force in investing. So, recognize and manage your emotions and boost your chances of achieving long-term financial success.

Share With